Sanctions risks and regional development: Russian case

- DOI

- 10.5922/2079-8555-2024-1-2

- Pages

- 23-45

Abstract

Economic sanctions and countersanctions are expanding worldwide, posing spatially heterogeneous threats to most countries. The study aims to develop and test a methodology for assessing regional exposure to sanctions risks using Russian data. The share of foreign trade with the countries that introduced restrictions can be used to evaluate the exposure to new trade barriers. In several cases, this share exceeded 50 %, necessitating a rapid reorientation of product flows in Nenets, Khanty-Mansiysk Autonomous Areas, Komi, and Murmansk region. The Kaliningrad, Kaluga, and Leningrad regions exhibit high import dependence in the production sector, particularly in the automotive industry, due to their active involvement in global supply chains. Sanctions against large legal entities created risks for the stability of regional economies but the increase in demand for domestic products offset this impact. Foreign enterprises exiting the market posed risks of disrupting production chains but also provided opportunities for local business development. Before some countries introduced sanctions, their companies had held more than 20 % of the market share in Kaluga, Moscow region, and the city of Moscow. However, the share of foreign firms that announced complete withdrawal exceeded 5 % of the market only in the Komi, Samara, Leningrad, and Moscow regions. An integral index of exposure was proposed based on the mentioned indicators. Its value is lower for the regions with a more diversified economy and foreign trade. The greatest risks were observed in the closely connected to the European Union northwestern territories of Russia: Karelia, Komi, Kaliningrad, Leningrad, and Arkhangelsk regions. In 2022, regions with a high index value were more likely to experience a decline in economic activity, but in 2023, this impact was less explicit due to economic adaptation and transformation. Based on the results of the study, some recommendations can be formulated.

Reference

Introduction

In recent years, sanctions have become a significant instrument of world politics. These economic restrictions are widely introduced against countries, regions, individual legal entities, or individuals to change their actions by other countries and organizations. At the beginning of 2024, most countries were involved in these processes.<1> Moreover, the challenge of growing global contradictions means that any country or some of its regions in one form or another may be a subject to direct or indirect external restrictions,<2> which can be considered as exogenous shocks to economies.<3> Therefore, the governments of most countries and regional authorities have begun to pay greater attention to economic security [1], [2]. Accordingly, it is necessary to understand the scale, direction and consequences of possible threats, their monitoring and mitigation, and the sanctions risks analysis is becoming a more relevant scientific topiс. At the same time, the 2020 pandemic showed that external shocks and restrictions are possible not only because of targeted actions but also due to emergency situations.

After 2022, Russia has been a subject to an unprecedented number of sanctions [3] from the United States, the European Union (EU), Japan, Australia, Canada, and most Western countries. Various types of financial restrictions have been introduced, including refusal to lend, invest and insure cargo, export of certain goods and energy resources, and import of certain goods, including high technologies among many others. Countries that carry out such actions are called ‘unfriendly’ in the literature [1], and this term has received an official legal status in Russia.<4> Some companies from these countries were forced to leave the Russian market under pressure from their governments and public organizations [4]: close and/or sell their enterprises, and curtail investments [20].

These restrictions, despite the stated political goals, posed a threat to the social and economic development of certain regions and undermine the standard of living for their residents [5], [6], since it requires time and resources to reorient trade, technological and other flows, not to mention direct restrictions against Russian citizens — infringement of free movement rights, reduction of opportunities to receive medical care abroad, etc. Exposure to the described risks, coping and adaptation capabilities differ significantly between regions [9], [10], [11], [12]: territories more integrated into the global economy, including those bordering the EU, could suffer more. Regional authorities had to apply a set of measures to maintain the level of well-being of residents, depending on their exposure to these risks [13].

This article aims to propose and test a methodology for assessing the exposure of territories (as parts of countries) to the sanctions risks using Russian data as an example..

Methods

The following terminology is used in this article. Challenges are conditions that can lead to hazards and threats to the economic security of a country or its region [21], [37]. Hazards are circumstances (phenomena, events, processes) that pose specific threats. Threats create direct or indirect possibilities of causing damage, in particular, a decrease in GDP (gross domestic product) or in the living standards. Risk is a possibility with an identified probability of causing damage when a threat is realized. For example, one of the modern global challenges is the growth of international contradictions leading to trade, military, and other conflicts. This is associated with threats of expanding specific external restrictions, leading to numerous impacts of sanctions risks in exposed areas, for example, food shortages in poor countries due to transport barriers. Since there are quite a lot of threats and risks associated with sanctions, they lead to various hazardous impacts. To evaluate the potential impact of risks on specific territories, the first step is to assess whether the local economy or community is exposed to threats. For instance, severing trade ties in a region with no such connections would not result in negative consequences; hence, the risk value for this region would be zero. In the subsequent stage, which was not addressed in the study, an assessment of the region’s vulnerability to risks should be conducted. This involves evaluating the region’s capacity to withstand and adapt to risks [31].

Based on a review of the literature on sanctions [5], [7], [10], [11], [14], [15], [16], [17], [18], considering the available data, a set of indicators was proposed to assess regional exposure to sanctions risks<5> (Table 1). Еach indicator shows different aspects of sanctions risks, which could potentially lead to negative socio-economic consequences, that is, damage to the regional economy or community.

|

Threat |

Exposure |

Data source |

Different hazardous |

|

Threat of disruption of regional trade ties |

Share of exports to unfriendly countries in the region’s total exports in 2019—2021 |

Customs services of Russia and other countries |

Limited access to highly profitable markets of unfriendly countries |

|

Unpreparedness of transport system for reorientation of trade flows |

|||

|

Share of imports from unfriendly countries in the region’s total imports in 2019—2021 |

Customs services of Russia and other countries |

Breaking of trade chains with major partners |

|

|

Restrictions on the import of significant and technologically complex products |

|||

|

Share of imports in enterprise expenses for raw materials, supplies, semi-finished products, and components in 2019—2021 |

Federal State Statistics Service of Russia (Rosstat) |

Breaking of production chains with major technology partners |

|

|

Restrictions on import of critical machines, equipment, and technologies for production development |

|||

|

The threat of foreign economic isolation of the region’s largest enterprises |

Share of Russian companies from the US and the EU sanctions lists in the revenue of all companies in the region in 2017—2021 |

SPARK-Interfax |

Limited access to financial instruments and technologies of unfriendly countries |

|

Limited access to highly profitable markets of unfriendly countries for the largest regional enterprises |

|||

|

Threat of foreign companies leaving the region |

Share of foreign companies from unfriendly countries in the revenue of all companies in the region in 2018—2020 |

SPARK-Interfax |

Potential exit from the Russian market of all companies from unfriendly countries, followed by the closure of enterprises and increased unemployment. |

|

Severing of production and other connections between enterprises of unfriendly countries on Russian territory with global networks |

|||

|

Share of companies that announced their departure from Russia in the revenue of all companies in the region in 2017—2021 |

SPARK-Interfax [20] |

Business closures and rising unemployment |

|

|

Loss of managerial, technological, and other competencies due to the departure of the company and the relocation of Russian employees abroad |

|||

|

Breaking ties between the enterprises of leaving companies in Russia and global manufacturing networks |

The indicators were used as an average for 2019—2021 values to reduce their annual variability and due to the ambiguous impact of the coronavirus crisis on the studied characteristics in 2020—2021. The values were taken until 2022, when most of the external restrictions were introduced against Russia, as the methodology entails assessing risks before the onset of an external shock. After the introduction of restrictions, regional and federal authorities began restructuring the economy and introduced several counter-sanctions, in other words, distorted the initial risk assessment. In essence, risks are evaluated here after the fact, when it is already known about the hazardous events and even approximate damage. Predictive assessment of such risks is much more difficult to perform.

First, the potential negative impact of trade restrictions on regional development must be assessed. This assessment can involve analyzing the proportion of imports and exports originating from and to potentially 'unfriendly' countries as a percentage of the total volume of imports and exports within the region. The higher are the values of the indicators, the higher is the exposure of the region’s economy to potential trade sanctions since significant efforts are required to find new markets, reorient transport flows, and conclude new agreements. A reorientation of the Russian economy to the eastern markets leads to multiple increases in transport and other costs for businesses to carry out foreign trade operations, especially for western and northwestern regions [21], [22].<6> If restrictions on exports from Russia led to the need for its reorientation, reduced business profits and regional budget revenues, then restrictions on imports to Russia affected the ability to purchase technological equipment, and components, and fulfill production orders. Thus, restrictions on imports led to the stoppage of the activities of numerous automobile factories in the Leningrad, Kaliningrad, Kaluga regions, and St. Petersburg after stocks were exhausted. In addition, orders to produce vessels for fishing companies, including those located abroad, in Norway and South Korea, were disrupted without the return of advance payments.<7>

If a region exports products to a group of countries that have imposed sanctions, then most often it is an active importer from these countries, and the correlation coefficient between these indicators is about 0.59 for Russia (Table 2). This is explained both by the geographical location of such regions near the European market and by the characteristics of global value chains: the import of materials from the EU is accompanied by the subsequent export of part of the finished product to the EU, for example in the automotive industry. Metrics have their drawbacks. A significant part of foreign trade is recorded through organizations registered in Moscow, which distorts the regional structure.

|

№ |

Indicators |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

|

1 |

Share of exports to unfriendly countries in the region’s total exports in 2019—2021, % |

0.59 |

0.06 |

0.11 |

– 0.22 |

0.14 |

0.67 |

– 0.25 |

– 0.23 |

|

2 |

Share of imports from unfriendly countries in the region’s total imports in 2019—2021, % |

1 |

0.08 |

0.08 |

– 0.19 |

0.18 |

0.66 |

– 0.24 |

– 0.12 |

|

3 |

Share of imports in enterprise expenses for raw materials, supplies, semi-finished products, and components in 2019—2021, % |

— |

1 |

– 0.07 |

0.34 |

0.12 |

0.46 |

– 0.3 |

0.01 |

|

4 |

Share of Russian companies from US and EU sanctions lists in the revenue of all companies in the region in 2017—2021, % |

— |

— |

1 |

– 0.07 |

– 0.04 |

0.27 |

– 0.06 |

– 0.04 |

|

5 |

Share of foreign companies from unfriendly countries in the revenue of all companies in the region in 2018—2020, % |

— |

— |

— |

1 |

0.09 |

0.31 |

– 0.19 |

0.09 |

|

6 |

Share of companies announcing their departure from Russia in the revenue of all companies in the region in 2017—2021, % |

— |

— |

— |

— |

1 |

0.5 |

– 0.15 |

– 0.05 |

|

7 |

Index of exposure to sanctions risks by regions of Russia |

— |

— |

— |

— |

— |

1 |

– 0.41 |

– 0.14 |

|

8 |

Index of output of goods and services for basic types of economic activity in 2022 |

— |

— |

— |

— |

— |

— |

1 |

0.13 |

|

9 |

Index of output of goods and services for basic types of economic activity in January-September 2023 |

— |

— |

— |

— |

— |

— |

— |

1 |

The share of imports in enterprise expenses for raw materials, semi-finished products and components (import dependence) was calculated<8> to assess the risks of import restrictions for critical machines, equipment, and technologies. Since most countries are actively involved in global value chains, a break in these chains leads to obvious problems with the supply of components, maintenance of machinery and equipment, sales of intermediate goods, etc. [16]. The higher the import dependence of an economy, the higher its risks of severing potential ties because of trade sanctions, the departure of foreign companies or rising transportation costs. Calculations of industrial import dependence [23], [24] can be applied to other countries. For Russia, there is a weak positive correlation of 0.06 between import dependence and the share of imports from unfriendly countries, as well as between import dependence and the share of exports to them (0.11), since many materials and components were imported from friendly and neutral countries, including the Eurasian economic community (EAEC).

Secondly, it is important to assess the potential impact of direct sanctions restrictions on specific legal entities on regional development.<9> In the Russian case, the calculation involved determining the share of organizations included in the US and EU sanctions lists in the revenue of all organizations in the region. Being included in these lists meant restrictions on access to technology, investment, and foreign trade; it created a threat of foreign economic isolation for the largest enterprises in some regions. The restrictions could lead to a decrease in economic activity and employment. Sanctions against one company inevitably lead to risks along the value chain [25]. Therefore, this influence was stronger if the role of the organizations in the regional economy was higher. However, in the previous period of sanctions (2014—2022) Russian businesses found ways to circumvent restrictions [18], and sanctions did not have a lasting negative impact on their economic performance, although the losses were significant [26]. In the manufacturing industry, 69 % of Russian companies reported the impact of sanctions in 2022, and slightly more than half of them reported the negative nature of this impact [27], that is, there were also companies that either did not feel or assessed the impact as positive. At the same time, long-term consequences for these companies are associated with decreased access to new technologies and increased cost of technological re-equipment, which was observed in Iran [28].

Thirdly, it is necessary to assess the potentially negative impact of foreign companies exiting regional markets. Companies owned by legal entities and/or individuals from unfriendly countries [17],<10> as well as those who announced their complete departure from Russia after 2022 [20]<11> were identified. The exit led to the breakdown of ties, the suspension of enterprise activities, the cessation of investment and access to new technologies, and an increase in the number of unemployed [29], depending on the role of these companies in the regional economy. At the same time, it could create conditions for the development of domestic small and medium-sized businesses, as new market niches opened [30]. The two indicators under consideration weakly correlate with each other (0.09): the first indicator assesses the overall involvement of foreign businesses from unfriendly countries in the region’s economy, indicating the maximum exposure to a decrease in ties. The second evaluates possible risks arising from the departure of individual companies. The lack of connection further shows that the companies’ reported withdrawal from Russia was not directly related to the potential risk of real exit of all foreign firms.

An integrated index based on the six indicators was compiled (Table 1) to understand the degree of exposure of regional economies to sanctions risks. All indicators were normalized using the linear scaling method (max.-min.) and summed up with equal weights, that is, they are assumed to be equivalent. For verification purposes, the author compared different index construction methods (with different weights and summation methods): the results showed a high degree of correlation. As expected, all values of the initial indicators are positively correlated with the integral index (Table 2), with foreign trade risks having a stronger impact than others.

High exposure does not always lead to increased risks, since the latter is also influenced by vulnerability, that is, the region’s capability to withstand risk and adapt [31], which was not considered in this study. For example, the share of unfriendly countries in foreign trade is only an indicator of foreign trade’s exposure to sanctions restrictions, but the region’s economy may be weakly vulnerable to this risk if it is generally oriented towards the domestic market, like the Kostroma region, the Republic of Khakassia, etc. The share of foreign companies that could potentially leave Russia (and or announced their decision to leave announced it) may be weakly related to the actual closure of enterprises and suspension of production, since the factories cannot actually leave, only their brands and owners changed. Thus, the discussion revolves around the potential impact of sanctions pressure, while regional economies could differ significantly in the observed reaction to such an impact.

At the last stage, all indicators and the integral index were compared with the values of the index of output of goods and services for basic types of economic activity according to available data in 2022 and in January — September 2023 (hereinafter referred to as the output index (Table 2). The latter indicator can serve to indirectly assess the dynamics of the regional economy, since it is calculated based on data on changes in the physical volume of agricultural, industrial production, construction, trade turnover, transportation, and storage.<12> The indicator is used for operational assessment since the calculation of the gross regional product in Russian statistics is carried out and published with a lag of 1.5— 2 years. It was expected that each of the indicators under consideration and the integral index would be negatively related to the output index since the described risks in the short term are mainly realized in a decrease of economic activity.

Results

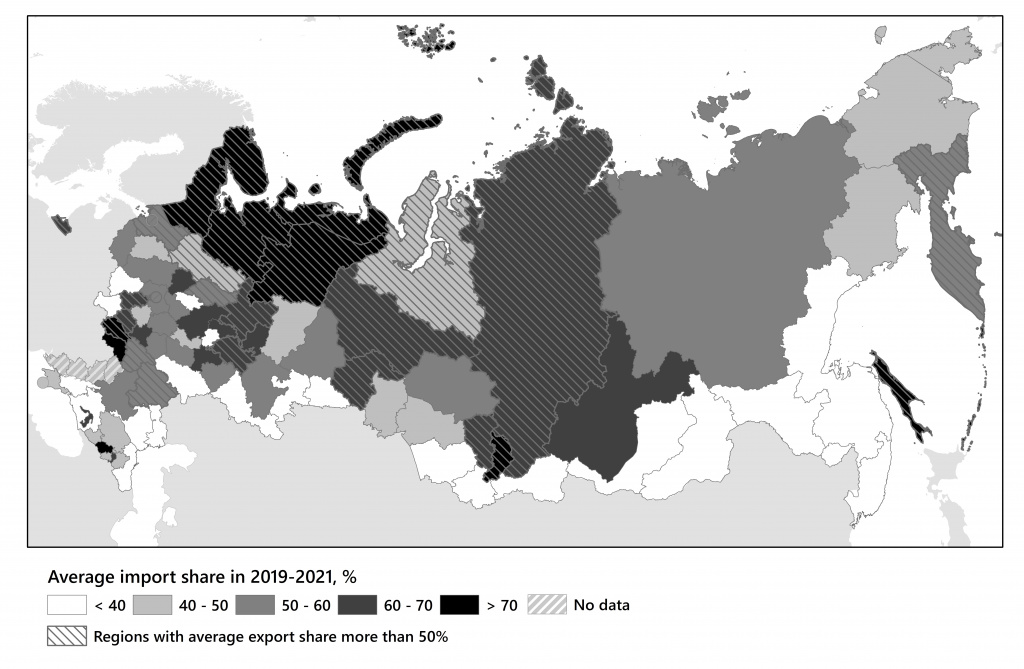

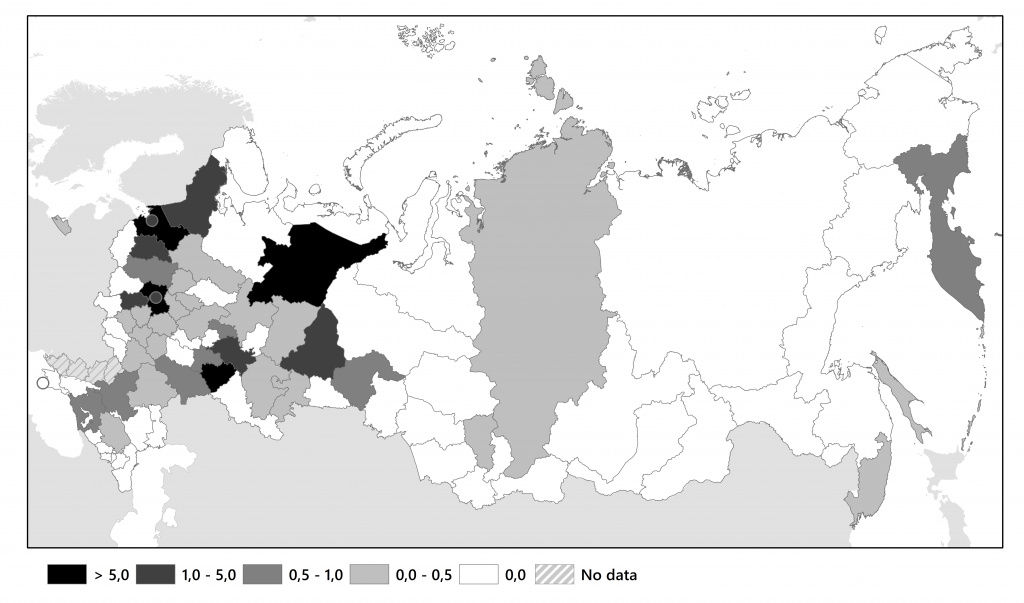

Trade sanctions against Russia, introduced after February 2022, caused a severance in logistics and production ties, a shrinking of sales markets and the purchase of goods. Almost 40 % of companies used foreign goods and services, and the absence of the latter critically affected their business.<13> The regions with the higher share of exports and/or imports to/from unfriendly countries were hit harder [32]. More than 90 % of exports to countries that imposed sanctions were in the Nenets Autonomous Okrug, Kostroma and Murmansk regions (Fig.1), this share was high in regions exporting energy resources: in the Tyumen region, Khanty-Mansiysk Autonomous Okrug, Tatarstan, Komi and Kemerovo region, as well as in regions focused on the export of wood and lumber to the EU: the Republic of Karelia, Arkhangelsk, Vologda regions and the Komi Republic. At the same time, in Russia, the share of companies that exported their products only to unfriendly countries was about 18.7 % in 2020, but more than half were in regions bordering unfriendly countries: Pskov, Kaliningrad, Belgorod, Murmansk regions, Karelia; for imports the similar figure was about 6 %.

|

| 1 |

|

The role of unfriendly countries in the import and export of Russian regions |

|

Source: calculation is based on the data of the Federal Customs Service of the Russian Federation. |

The lowest level of involvement in trade with countries that have imposed sanctions is observed in the southern regions of the Far East which are focused on Chinese markets, and in the territories bordering Kazakhstan. Also, some large, diversified centres, remote from the borders and focused on the domestic market, had less involvement: Perm Territory, Chelyabinsk, Omsk, and Novosibirsk regions.

Enterprises quite quickly began the process of reorienting foreign trade flows. Thus, the share of unfriendly economies in exports from Russia decreased from 58 %<14> to 35 % in 2022, the share of exports to unfriendly countries was about 20 %<15> and in imports is about 25 %<16> in 2023.<17> The reorientation of flows required significant investments in infrastructure in the eastern regions and along the borders with neutral countries [11]. The correlation coefficient of the share of imports from unfriendly countries with the output index for basic types of economic activity in 2022 was – 0.24 (Table 2), decreased in the second half of 2023 to – 0.12 after the reorientation of flows, but the negative correlation with exports remained ( – 0.24), which may be due to the expansion of restrictions on the export of gas, oil and petroleum products from Russia. Low values of the correlation coefficient itself, that is, the relationship between economic dynamics and exposure to the risks of trade sanctions, may be explained by significant reserves of enterprises that were accumulated in response to the risks of disruption of trade chains, already observed during the pandemic.

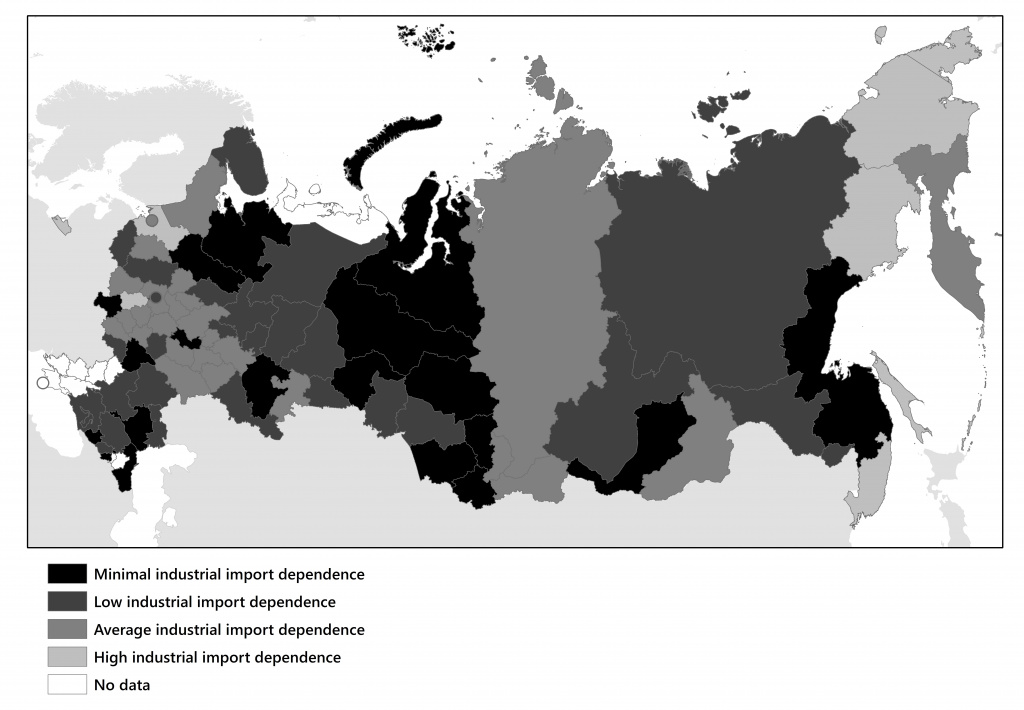

Some regions, actively involved in trade with Western countries, purchased equipment from these countries, so the share of foreign materials and components in the imports of manufacturing enterprises was high. This share was higher in regions where foreign automobile manufacturing plants had previously been built.: Kaliningrad, Kaluga, Leningrad, Samara regions, and the Republic of Tatarstan (Fig. 2). Production import dependence is lower in the least developed regions, which are poorly integrated into global chains, as well as in regions of central Russia (Urals and Siberia), remote from global trade flows. Import dependence is negatively related to the output index in 2022 (– 0.3), but the correlation coefficient became close to zero in January — September 2023 (0.01) as flows were redirected, and production based on domestic materials was launched.

|

| 2 |

|

Industrial import dependence of enterprises in Russian regions in 2019—2021 |

|

Source: compiled according to article [23]. |

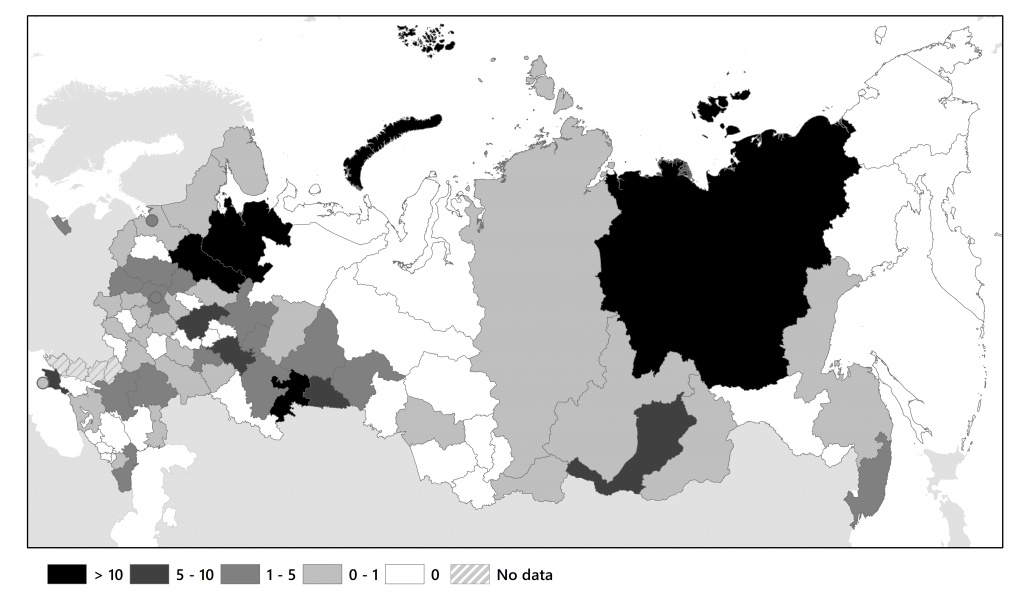

The US and EU countries have imposed sanctions restrictions on 567 legal entities (LEs) in Russia,<18> including the largest banks, research organizations, and high-tech enterprises. Companies from the sanctions list are represented in 53 regions and account for approximately 2.3 % of the revenue of all companies in Russia. A high share of these companies in the market was observed in several manufacturing regions (Vologda, Arkhangelsk, Chelyabinsk), as well as in Crimea (Fig. 3).<19>

|

| 3 |

|

Estimated share of legal entities included in the EU and US sanctions lists in the total revenue of all companies by region in 2017—2021, % |

|

Source: calculated according to Rosstat and SPARK-Interfax data. |

In 2020, there were 22,906 companies in Russia that were 50 % or more owned by legal entities and/or individuals from unfriendly countries (except Cyprus). Their revenue was approximately 16 trillion roubles, and their share in the revenue of all Russian companies was approximately 10 % [17]. Most of the proceeds belonged to companies whose owners are registered in the Netherlands, Germany, Switzerland, and France. About 52 % of the revenue of these companies was generated in wholesale and retail trade, and another 29 % in manufacturing. The share of these companies in the revenue of several service industries was high: hotels and restaurants, finance, information and communication technologies and trade. In the manufacturing industry, this share exceeded 10 %. In trade and the service sector, the share of small and medium-sized businesses is high, the barriers to entry for startups are lower, and therefore the possibility of filling emerging market niches after the departure of foreign companies is higher [30]. In production areas, there is less opportunity for rapid restructuring due to the need for large capital investments, the development of competencies, cooperation, and other factors.

Russian regions are characterized by high heterogeneity in the share of revenue generated by foreign companies from unfriendly countries (Fig. 4). The highest share was observed in a few large industrial centres where foreign companies were represented in manufacturing industries (Moscow, Moscow, Leningrad, Kaluga, Vladimir, Belgorod regions, Komi Republic), as well as in regions with an advantageous border position (Kaliningrad, Leningrad regions, Primorsky Krai). These regions face the greatest risks [29], but in some of them there are also higher opportunities for the development of small and medium-sized domestic enterprises in the service sector [30], for example, in large agglomerations and near them: in Moscow, the Moscow and Nizhny Novgorod regions.

|

| 4 |

| Estimated share of foreign companies from unfriendly countries in the total revenue of regional organizations in 2018—2021, % |

|

Source: calculated based on SPARK-Interfax data. |

The risks are lower in the regions that are less integrated into Western production chains due to their orientation to the east (Khabarovsk Territory, Krasnoyarsk Territory, Irkutsk Region), due to the significant role of large local businesses (Krasnoyarsk Territory, Tomsk Region, Omsk Region, Bashkortostan), due to an unfavourable business climate, for example, in some southern regions.

As expected, if the share of considered companies in regional markets was high, then the output index was lower in 2022 (correlation coefficient – 0.19), but in the first half of 2023 the situation was the opposite (+ 0.09), which may indicate a reorientation of consumers to local brands after the release of market niches or continuation of enterprises activity in Russia after a change in the ownership structure.<20>

As of mid-2023, 890 companies announced their complete withdrawal from Russia, of which only 462 had previously registered a legal entity in Russia, and therefore had revenue officially recorded by the tax authorities [20]. These companies accounted for approximately 2.1 % of the revenue of all companies in Russia and were represented in 41 regions (46 %). The highest share of these companies in the regional market is noted in the Komi Republic (11.5 % of revenue was provided by only one company, Mondi, which specialized in pulp and paper production) and in the Samara region (10 % of revenue was provided by three companies associated with the auto industry). Also, a significant share of large foreign companies that announced their departure was (in descending order) in the Leningrad region, Moscow region, Moscow, and Sverdlovsk region (Fig. 5).<21>

|

| 5 |

| Estimated share of companies announcing their departure from Russia in total revenue by region on average in 2017—2021, % |

|

Source: compiled according to data from [20]. |

|

Regions |

Share of foreign companies that announced their exit from the Russian market in the revenue |

The largest foreign companies |

|

Komi Republic |

11,5 |

Mondi (pulp and paper industry) |

|

Samara Region |

10 |

Reno, GM, Faurecia (automobile industry) |

|

Leningrad region |

5,9 |

Nokian, Ford, ИКЕА, Sсhneider Electric, |

|

Moscow region |

5,1 |

AirBaltic, Ikea, Lufthansa, Toyota, et al. |

|

Moscow |

4,1 |

Renault, Henkel, Fortum, McDonald’s, Adidas, Tetra Pak, Dell |

|

Sverdlovsk region |

3,6 |

Enel, Holcim, Mondi |

|

Source: compiled from data from the article [20]. |

||

The output index negatively correlates with the mentioned indicator in 2022 (– 0.14) but it is close to zero in 2023 (– 0.05). This is due to the insignificant influence of the companies on the economy of most regions (Fig. 5). In addition, most of the enterprises did not cease their activities in Russia, but only announced this, or sold their assets to other owners, or transferred them to local management without a significant period of shutdown.

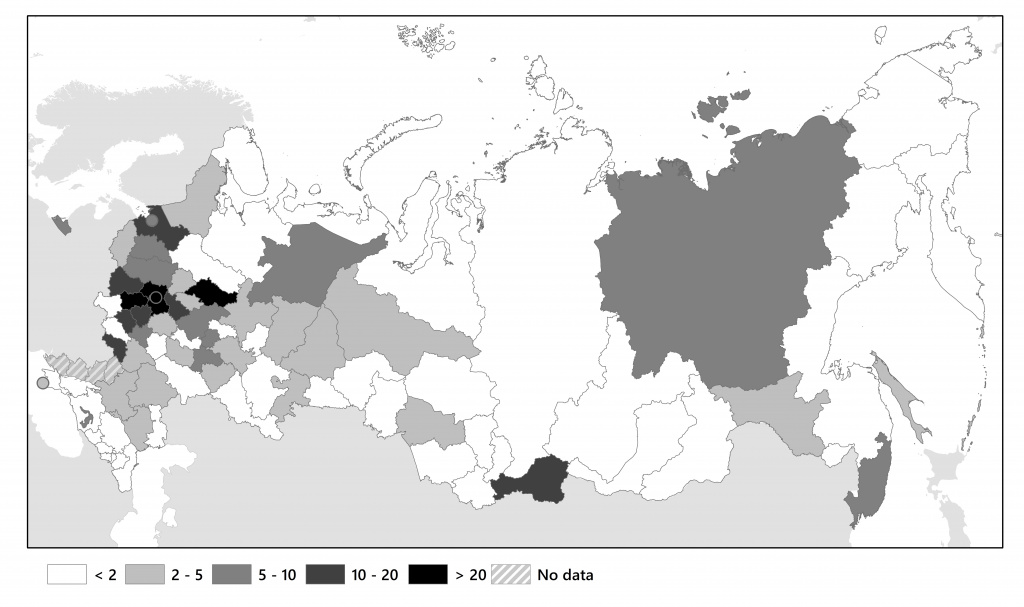

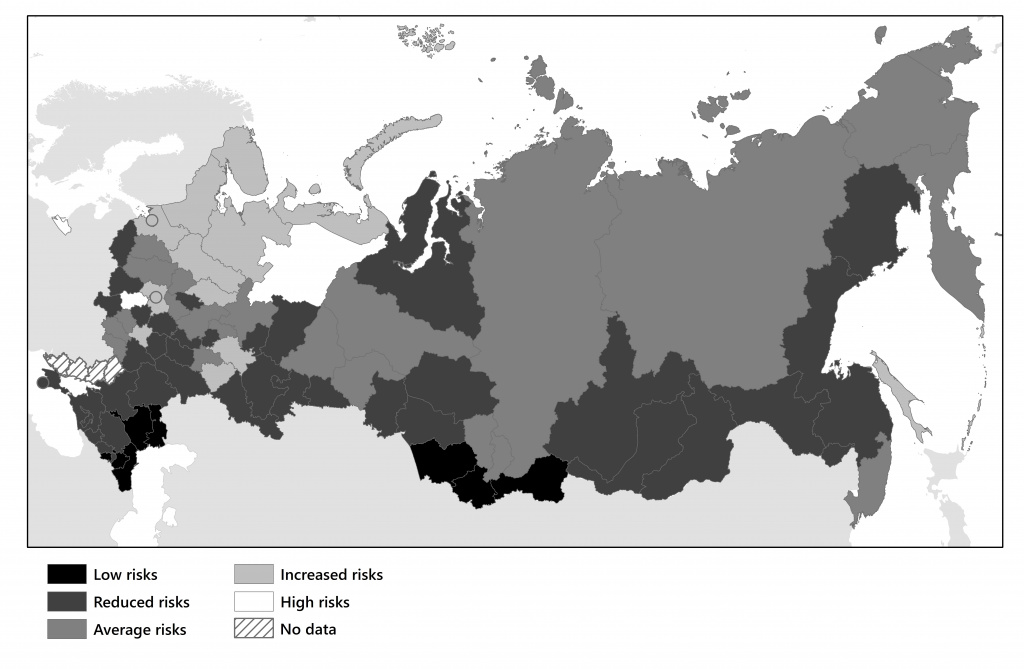

Finally, the integral index of exposure to sanctions risks was calculated (Fig. 6). The index value was higher for the northwestern regions (Komi Republic, Kaliningrad, Vologda, Leningrad, Arkhangelsk regions, Republic of Karelia), where close trade and cooperation ties were formed with geographically close countries of the European Union, as well as in automobile manufacturing centres previously integrated into global production chains by transnational corporations (Kaluga, Leningrad, Kaliningrad, Samara regions, Republic of Tatarstan, Moscow). All three regions on the Baltic Sea: St. Petersburg, Kaliningrad, and Leningrad regions, as expected, were exposed to the greatest impact of sanctions risks [33]. For the Kaliningrad region, these risks became a significant incentive for a radical transformation of the economy and foreign trade relations [34].

Reduced exposure to risks is typical of many large, diversified regions with a high share of manufacturing industry: Perm, Khabarovsk Territory, Rostov, Tomsk, Novosibirsk, Irkutsk, Omsk, Chelyabinsk, Volgograd, Voronezh, Bryansk, Tula, Ryazan regions, the Republic of Bashkortostan, Udmurtia. The largest manufacturing enterprises operate there.

Most Asian and Far Eastern regions with low and medium exposure to risks have high diversification of trade flows, including orientation to the markets of the Asia-Pacific region: Irkutsk, Amur, Tomsk regions, Khabarovsk, Krasnoyarsk, Transbaikal Territory.

The least impact of risks was observed in regions remote from global markets (Altai Territory, the Republic of Tyva and Altai) and less developed (the Republics of Dagestan, Chechnya, Kalmykia, Altai, and Tyva), and, accordingly, less involved in trade, production and other ties with developed unfriendly countries. The republics of the North Caucasus, due to their proximity to neutral countries, were able to take advantage of the redirection of trade flows, including results of allowing parallel imports<22> [17], and attracted additional domestic tourists due to restrictions on the movement of Russian citizens abroad.

In regions with a high value of exposure, there was a lower index of output in 2022 (correlation coefficient is – 0.41), that is, there was a higher probability that the regional economy did not grow. However, the correlation coefficient dropped to – 0.14 in January — September 2023. The transformation of most regional economies can be confirmed by the fact that the overall Russian economy (GDP) in 2022 decreased by 1.2 % according to Rosstat, but in 2023 it grew by 3.6 %.<23>

|

| 6 |

| Index of exposure to sanctions risks in Russian regions |

|

|

|

Rank |

Regions |

Index |

|

Regions with the highest exposure to sanctions risks |

||

|

1 |

Komi Republic |

0.44 |

|

2 |

Kaluga region |

0.41 |

|

3 |

Kaliningrad region |

0.41 |

|

4 |

Vologda Region |

0.38 |

|

5 |

Leningrad region |

0.38 |

|

6 |

Moscow region |

0.36 |

|

7 |

Arkhangelsk region |

0.35 |

|

8 |

Samara Region |

0.35 |

|

9 |

Sakhalin region |

0.34 |

|

10 |

Lipetsk region |

0.34 |

|

Regions with the lowest exposure to sanctions risks |

||

|

76 |

Khabarovsk region |

0.12 |

|

77 |

Tomsk region |

0.12 |

|

78 |

Altai Republic |

0.11 |

|

79 |

Tyva Republic |

0.09 |

|

80 |

The Republic of Dagestan |

0.08 |

|

81 |

Chechen Republic |

0.08 |

|

82 |

Republic of North Ossetia-Alania |

0.08 |

|

83 |

Astrakhan region |

0.07 |

|

84 |

Altai region |

0.06 |

|

85 |

Republic of Kalmykia |

0.02 |

Conclusion and recommendations

The expansion of sanctions and similar risks has become of interest to researchers; one can even talk about the emergence of a new direction of scientific research — ‘sanctionomics’, which studies the tools and consequences of sanctions policies. In our opinion, it may have some theoretical significance in terms of developing the concept of shock resistance or resilience of economic systems [35], [36]. Moreover, in practical terms, these studies may serve the purpose of strengthening regional economic security [37].

As the analysis shows, sanctions risks have a spatially heterogeneous impact. In regions having more intensive ties with countries that imposed sanctions, the risks of a decline in economic activity were higher due to interruptions in supplies and limited access to markets [12]. However, a reorientation of trade flows is feasible given the availability of financial, transport, entrepreneurial, and other resources, and competencies. Sanctions against legal entities create risks of decreased economic activity in the regions of their registration due to restrictions on access to foreign finance, technologies, and markets. On the other hand, the increase in demand for local products compensates for this impact, including through government procurement. In addition, the owners of many of these enterprises seek to reduce the risks of property expropriation abroad by investing more within the country and core regions (forced reshoring). The departure of foreign companies from the Russian market has led to disruptions in production chains and, in some cases, an outflow of specialists. However, it has also opened up market niches for local businesses. In trade, after parallel imports were allowed, opportunities arose for the emergence and growth of small firms in regions bordering friendly and neutral countries [17]. Domestic tourism and, accordingly, the service sector grew in 2023 due to restrictions for many Russians on crossing borders. However, many risks may not directly manifest themselves in short-term economic dynamics, for example, outflow and shortage of specialists due to relocation or lack of technology and the inability to import necessary equipment.

The exposure of regional economies to sanctions risks assessed in the article correlates with a potential short-term decline in economic growth, but economic dynamics depend on the adaptation capabilities of businesses and residents, and on the competence of the authorities. In regions with diversified economies and foreign trade relations [38], with proactive government policies, the likelihood of negative growth rates is generally lower. These regions can benefit from the results of a counter-sanction policy of import substitution (increased government procurement and demand for domestic analogues) and reorientation of trade, investment, and other flows. For instance, although the Lipetsk region faced significant exposure to sanctions risks in Russia, its economy is relatively diversified. In previous years, the regional authorities pursued a proactive policy to attract investors and develop the manufacturing industry and in the new conditions, increased demand for metalworking and mechanical engineering products created the basis for economic growth. Therefore, although the output of basic products and services in the region decreased in 2022, it grew in January — September 2023.

Whatever the external shocks to the regional economy, a long-term strategy is needed to increase its resilience [36]. Such a strategy could include a wide range of measures: from improving transport accessibility to economic and trade diversification. It is imperative to attract investors from various countries and regions, thereby prohibiting reliance on one or a few closely associated partners. It is possible to stimulate the diversification of foreign trade flows [38] by holding international forums, fairs, and the participation of business delegations in similar events abroad. It is important to establish a wide network of friendly, including personal, ties with neighbouring regions and coastal regions [39]. An effective strategy is to diversify the regional economy through the development of complementary activities (smart specialization) and the completion of value chains within the region [40], [41], strengthening state support for some of the most import-dependent industries through subsidies, investments in science and government procurement [42], [13], stimulating broad entrepreneurial activity that promotes rapid adaptation of consumer markets in the face of shocks [30]. Reducing import dependence will require greater integration of education, science, and the manufacturing sector to develop new products and services as part of a smart specialization strategy [41].

A separate important area is the training and attraction of personnel to the region in conditions of their shortage [42]. It would also be useful to talk about increasing fiscal shock resistance [43]: low and moderate debt burden, accumulation of reserve funds denominated in different currencies, but kept and invested within their own country, introduction of a ban on placing funds in one country (or a potential bloc of countries). At the same time, regional authorities most often solve current problems without proper long-term planning, which predetermines the need to create a development agency with broad powers [39]. Regional authorities should develop a system for monitoring long-term external risks, which should be considered when developing strategic documents [22], [36]. The problem of external restrictions is not reduced to the sum of local risks but requires a more complex, systematic approach to assessing risks throughout a country’s entire economy.

The research was conducted as part of the state assignment of RANEPA. The author would like to thank Andrei Mikhaylov for his assistance with calculations and preparation of cartographic material; Yuri Zemlyansky, Alexander Knobel, R. Bobrovskiy for their help in obtaining the data, and the reviewers for their valuable comments.