Priorities for the development of manufacturing industries in the Kaliningrad region

- DOI

- 10.5922/2079-8555-2023-4-7

- Pages

- 124-141

Abstract

The Kaliningrad region is a socio-economically developed area with a steadily increasing population. Its economy is predominantly influenced by manufacturing industries, whose growth is supported by the region’s strategic geographic position on the Baltic coast and the Special Economic Zone (SEZ) regime. However, the region’s exclave status, which makes it reliant on external factors, hinders its development. Any change in these external factors could necessitate a restructuring of manufacturing industries. The severing of former foreign economic and social ties, the discontinuation of cross-border cooperation due to the actions of unfriendly countries, and the imposition of eleven packages of unlawful anti-Russian sanctions have had a more pronounced impact on the regional economy compared to the country’s inland regions. Logistics between the region and the main part of the country have been significantly complicated. Manufacturing industries have faced disruptions in the supply of essential foreign-made semi-finished products. The exports of several regionally-produced goods have been restricted, and transit through the Baltic States has become more difficult. This article aims to assess the impact of these restrictions on the development of manufacturing industries in the region. Another goal is to provide a rationale for the restructuring of specialization and changes in the geography of external relations in these increasingly complex external circumstances. Recommendations based on the findings obtained will contribute to the region’s sustainable development, characterized by dynamic growth and proportional development.

Reference

Introduction

Kaliningrad is one of Russia’s more socio-economically prosperous regions with numerous manufacturing businesses, whose development was supported by the Special Economic Zone regime (SEZ 1996, 2006). Whilst location along the Baltic Sea coast is an advantageous factor, the exclave nature of the territory hampers its development by creating economic dependence on external players. Changes in the geoeconomic landscape of the Baltic Sea area have more than once caused a restructuring of the region’s manufacturing industry. A factor with unclear implications is proximity to EU countries, with which the region had enjoyed close economic, academic, social, and other transboundary ties before the war of sanctions was waged on Russia. Kaliningrad boasted a range of joint companies engaged in manufacturing, catering to both Russian and international markets. Competition with cheap imports from the neighbouring states, however, tended to impede the development of local businesses.

The external conditions of the region’s economic development have been changing since 2014, when unfriendly states introduced restrictions, i. e., unlawful sanctions, against Russia. This process is having a particularly pronounced effect on the manufacturing industry. This article aims to describe the effect of restrictions on the development of regional manufacturing companies, measure the resilience of such businesses to external impact, and provide a rationale for the necessary sectoral restructuring and changing the geography of external ties. To this end, we analyse the literature and employ economic statistical methods to process company-specific statistical data on production for 2022 and the first six months of 2023.

Transformation of strategic development areas for the Kaliningrad region since the early 1990s

The region’s manufacturing facilities came to a near standstill in the 1990s, prompting the search for specialisations the region could embrace in the changed environment. Not only was the idea of creating an amber processing cluster widely discussed in Kaliningrad but also a correspondent goal appeared in the national programme for industrial and business development in the region.1 A range of studies provided a rationale for cooperation in the Baltic area, a course of action viewed as mutually beneficial in the geopolitical environment that evolved after the collapse of the USSR. Kaliningrad scholars published on the theory of transboundary regions, whilst striving to link theoretical insights with economic practice [1], [2]. Mutual ties were also the focus of Western researchers [3], [4]. The book Kaliningrad in Europe, published at the initiative of the Council of Europe, provided a platform for Russian and Polish scholars to discuss various aspects of cooperation [5]. However, some of the regional strategy proposals contained unacceptable suggestions to isolate Kaliningrad from mainland Russia, introduce governance of the territory by an international consortium, etc. One of the articles, on one hand, discusses the region’s participation in several European cooperation networks and, on the other, groundlessly depicts the territory as a possible tool for creating threats to other states of the Baltic Sea region (see [6] for a detailed analysis).

Polish researchers have made a noticeable contribution to the study of transboundary ties. Prof. Tadeusz Palmowski of the University of Gdansk provided a theoretical framework for the bipolar socio-economic system Tricity (Gdansk—Gdynia—Sopot)—Kaliningrad [7]. Experts from McKinsey, a management consulting company, drew up a strategy for the region with a focus on tourism development.<2> Finnish professor Urpo Kivikari outlined a theoretical underpinning for integration processes in the Baltic region [8]. Several experts pointed out problems that the region could experience in its relations with Russia and other countries [9], [10].

The 1990s and the early 2000s witnessed animated discussions in Russia and abroad about potential development trajectories for the Kaliningrad region. One of the proposals centred on the idea of a ‘region of cooperation’ [11]. The early 2000s strategic document for the region’s development had a befitting name — A Strategy for the Development of Kaliningrad as a Region of Cooperation.<3> However, it became increasingly evident that implementing such a strategy would be challenging, particularly due to the external environment, which notably changed after the Baltic States acceded to NATO and the EU in 2004. Necessary amendments were made to the regional strategy.<4> The changed circumstances prompted Russian experts to turn their attention to the economic security of the Russian Baltic exclave, whilst the state saddled itself with ensuring the region’s self-sufficiency as regards natural gas, electricity, and food products [12].

After the EU imposed sanctions against Russia in 2014, Russian—(Western) European trade dwindled. This reduction occurred mostly in terms of physical volumes. In terms of value, as the RIA Novosti agency reports with a reference to Eurostat data, 2002 saw an increase in Russian—European trade by 2.3 %<5> due to the growing global prices of goods constituting Russia’s exports [3]. The country’s Baltic regions, once dubbed a ‘window to Europe’ were becoming less visible as economic players [13].

Western authors are increasingly viewing Kaliningrad from the geopolitical rather than economic perspective, focusing on its socio-economic situation and relations with neighbours against the backdrop of the events of 2022 and 2023. Even scholars from remote countries such as the US and Australia address the region in their publications<6> [14].

An entire 2022 issue of the Finnish journal Baltic Rim Economies was dedicated to Kaliningrad, featuring publications from international and Russian authors, with Kaliningrad transit through Lithuania and the region’s transportation links with the rest of Russia garnering significant attention [15], [16].

Much is being written about the need for a military confrontation with Kaliningrad as an allegedly militarised territory threatening NATO countries [17], [18]. Other publications explore presumed changes in the social well-being of Kaliningraders [19].

In the new external environment, organisations with well-established foreign economic ties not only faced challenges relating to development but often struggled with performing routine operations. Several Russian authors have explored the business activities of the region’s manufacturing industries, identifying production companies with the most potential. For instance, Anastasiya Kuznetsova emphasises the low value-added generated by enterprises enjoying SEZ 1996 customs privileges and engaged in import substitution. She also stresses the massive budgetary expenditure on compensating for the customs duties levied on such companies under SEZ 2016, which came to replace SEZ 2006 [20]. Therefore, it appears necessary to raise the value-added target for such organisations. In the same series of articles, Vladislav Ivchenko investigates the possibility of maritime transport as the backbone of economic cooperation between the region and St. Petersburg [20]. The literature also pays attention to the prospects of reverting the fishing industry to its past capacity [22], embracing new technology, introducing innovation into production, and creating innovative clusters [23], [24].

In his annual message, Governor Anton Alikhanov stressed inter alia the need to reorient international ties towards Belarus, other CIS states, and South and Central Asia.<7>

The current strategy for the region’s socio-economic development defines as priorities the following industries:

— information technology;

— mechanical engineering, with a focus on motor vehicle production and shipbuilding;

— the amber and jewellery cluster;

— fishery;

— food processing.<8>

Along with these sectors, experts see as promising the pharmaceutical industry,<9> and the national spatial development strategy lists as many as thirteen production areas.<10> Below we will investigate the situation in the Kaliningrad region in greater detail, including the developments the occurred between 2022 and 2023. We will also discuss possible trajectories of economic development in the changing external environment.

Stages in the development of manufacturing companies, from 1991 to 2023

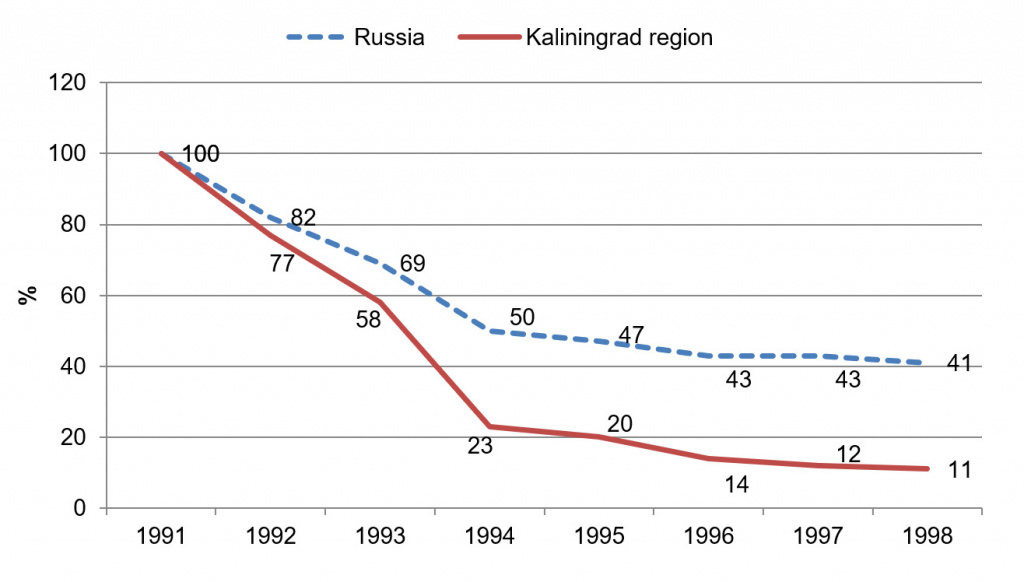

By the early 2020s, the Kaliningrad region had established itself on the national level as a significant manufacturing centre. In 2021, its companies accounted for 1.2 % of the national manufacturing production, whilst the population of the region did not exceed 0.7 % of the Russian total. The production output, both in absolute terms and relative to the national figures, had increased significantly compared to the 1991 level. Yet, this rise followed the decline of the 1990s, which was more dramatic in the region than across the country. In 1998, local production facilities performed at 11 % of their 1991 capacity (Fig. 1). The territory also lost its previous specialisation in the fishing, pulp and paper, and machine engineering industries.

|

| 1 |

|

Manufacturing industry production indices, 1991—1998, % of the 1991 level |

|

Prepared based on the data from index of production (percentage, value of the indicator for the year), EMISS, URL: https://www.fedstat.ru/indicator/43047 (accessed 02.08.2023). |

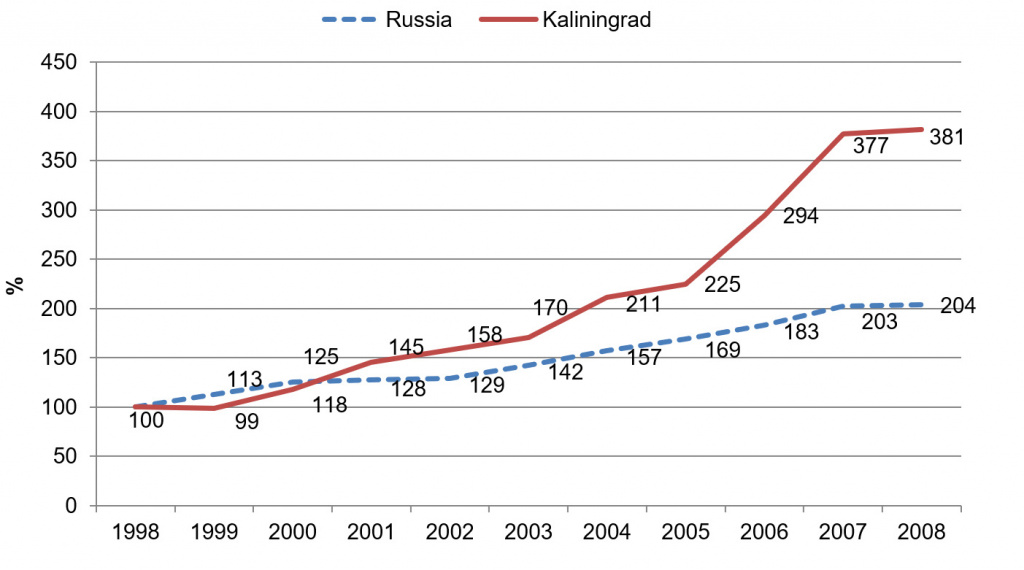

Starting from 1999, when the aftermath of the 1998 financial crisis was largely overcome, the Special Economic Zone (SEZ) established in 1996, along with the customs privileges granted to its tenants, began to exhibit effectiveness. New investors were arriving, and manufacturing industries started to develop at a faster pace than the national average (Fig. 2). Industries other than the Soviet-time premier sectors were gaining prominence, including the food industry and assembly (motor vehicles, televisions, computers, and household appliances). Most raw materials and semi-finished products for enterprises engaged in these fields were imported, whilst finished goods were mainly shipped to mainland Russia, with a smaller proportion remaining in the regional market or being exported.

|

| 2 |

| Manufacturing industry production indices, 1998—2008, % of the 1998 level |

|

Prepared based on data from index of production (percentage, value of the indicator for the year), EMISS, URL: https://www.fedstat.ru/indicator/43047 (accessed 02.08.2023). |

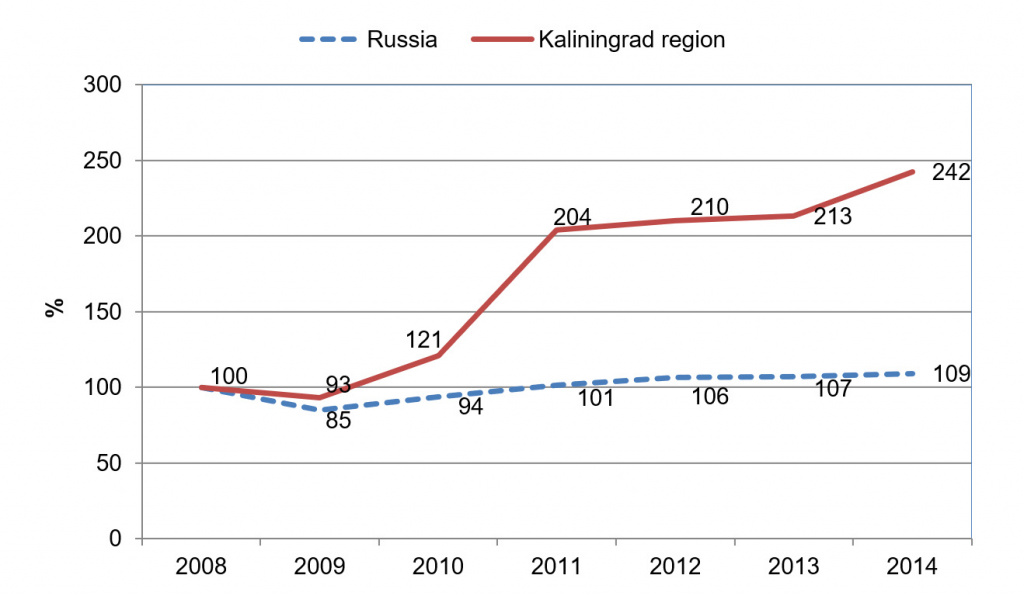

In 2006, a new law regulating the SEZ scheme was adopted to stimulate production through tax incentives rather than customs benefits. Although its effect was disrupted by the 2008 global economic crisis, sustainable production growth began as early as 2010, resulting in the establishment of new businesses supported by SEZ tax zones (Fig. 3). Manufacturing industries achieved considerably higher production levels per employee and per capita compared to the national average. By 2014, the production levels surpassed those of 1991 by a wide margin.

|

| 3 |

|

Manufacturing industry production indices, 2008—2014, % of the 2008 level |

|

Prepared based on data from Index of production (percentage, value of the indicator for the year), EMISS, URL: https://www.fedstat.ru/indicator/43047 (accessed 02.08.2023). |

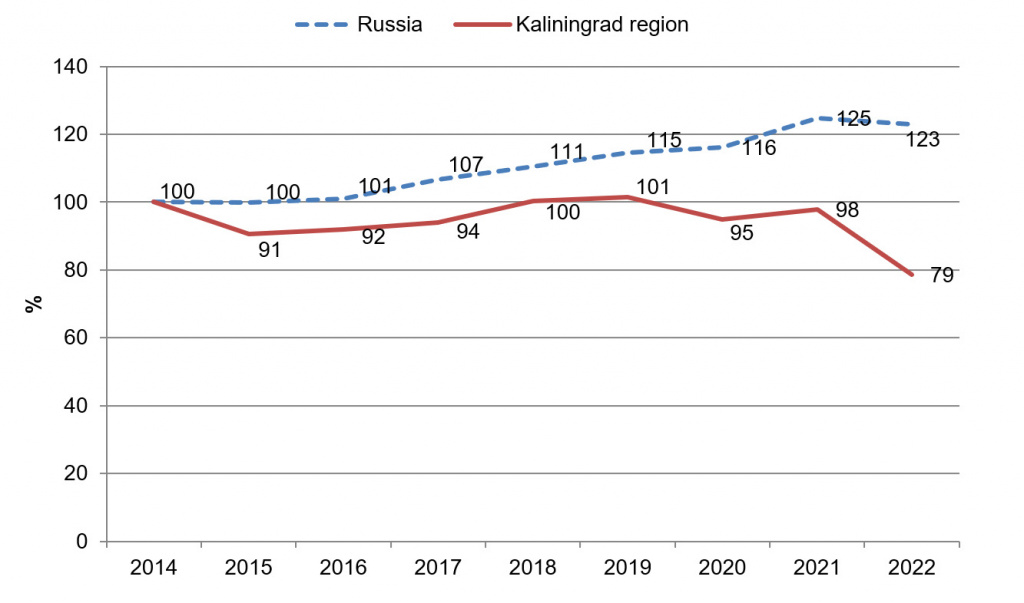

The region is more sensitive to the restrictions imposed by unfriendly nations compared to Russia’s inland regions (Fig. 4). After their introduction in 2014 and subsequent tightening, international ties with Baltic neighbours were suspended on the initiatives of the latter. The 11 sanctions packages imposed by the EU have prohibited the import of many hundreds of goods into Russia, supposedly with military significance, but often impacting the consumer market. Russian airlines have been banned from EU skies, and transit shipments by land have been limited as well. A growing proportion of freight transportation from mainland Russia to the region is now conducted by maritime transport, and the majority of passenger transportation is carried out by aviation, bypassing the Baltic States over the waters of the Baltic Sea. Connections with partners from friendly countries are strengthening, particularly with other Russian regions. For example, a considerable portion of both freight and passenger transport to other Russian regions is now conducted through St. Petersburg and the Leningrad region.

|

| 4 |

|

Manufacturing industry production indices, 2014—2022, % of the 2014 level |

|

Prepared based on data from Index of production (percentage, value of the indicator for the year), EMISS, URL: https://fedstat.ru/indicator/57806 (accessed 06.08.2023). |

The situation in 2022 and 2023

Despite stagnation in the region’s manufacturing industries observed from 2014 to 2021, the volume of goods shipped, work completed and services provided per employee exceeded 10 million roubles in 2021, which is 1.6 times the national average.<11>

In 2022 and 2023, Russia’s economy was developing in the conditions of increasing restrictions. After the 11th sanctions package was placed by the EU on 21 June 2023, the restrictions cover, according to our estimates, 1,124 types of goods, specified to from two to eight digits of international trade classification codes. These goods account for 78 % of the imports and 16 % of the exports of Kaliningrad production facilities, as seen in 2021.<12>

This list includes, amongst other things:<13>

‘<…>

Musical instruments, percussion (e. g., drums, xylophones, cymbals, castanets, maracas);

Swords, sabers, rapiers, cutlasses, bayonets, pikes, and similar weapons, parts of the listed weapons, scabbards, and sheaths;

Non-electric lamps and lighting equipment;

Parts of lamps and lighting equipment made of glass;

Products and accessories for all kinds of billiards;

Games operated by coins or tokens, excluding equipment for bowling;

Playing cards;

Game consoles and video game equipment;

Other entertainment goods, tabletop or indoor games;

Skis, ski bindings;

Other skis and other equipment for skiing;

Windsurfing boards;

Water skis and equipment for water sports;

Hockey sticks, sets;

Golf balls.’

As one can see, these are consumer goods that are unsuitable for use in the special military operation, but the discontinuation of their supply may temporarily cause inconvenience the civilian population.

Since 2022, international trade logistics has declined in Kaliningrad and other Baltic regions of Russia due to the sanctions imposed by unfriendly countries. Trade turnover with the Baltic region countries, formerly long-standing trading partners, as well as with other states, has also decreased. Being faced with bans or restrictions on exporting a wide range of goods and importing Western high-tech and other products, manufacturing industries have borne the brunt. Kaliningrad has been severely impacted by transit restrictions on Lithuanian transit, with local companies having to resort to more costly maritime connections between the ports of Kaliningrad and Leningrad regions. The refusal of access to EU skies has required rerouting flights from Kaliningrad to other regions of the country through the neutral waters of the Baltic Sea.

In the region, sanctions have severely affected the development of all manufacturing companies relying on raw materials and/or semi-finished products imported from unfriendly countries. The operating structure of these businesses, which explains their heavy dependence on exports and imports, calls for a thorough restructuring, as is the case with international trade ties. A viable solution is stimulating productions that rely on Russian raw materials and semi-finished products, including those from Kaliningrad, as well as on imports from friendly states. From 2017 to 2021, two sectors demonstrated outstanding results: the food industry (primarily, oil and dairy manufacturing), motor vehicle assembly, as well as the chemical, plastics, and pulp and paper industries.<14>

Table 1 shows the most imported commodity groups as of 2021, their composition explaining the manufacturing dynamics of 2002 and the first half of 2023.

|

Commodity |

Proportion |

Exporting country |

|

Land vehicles, excluding railway and tramway rolling stock |

30.4 |

South Korea, Slovakia, Germany |

|

Soya beans |

14.3 |

Brazil, Paraguay, Argentina |

|

Electric machines and equipment, sound recording and reproducing devices, devices for recording and reproducing television images and sound |

7.5 |

China, South Korea, US, Germany |

|

Equipment and mechanical devices |

7.4 |

South Korea, Germany, Slovakia |

|

Meat and meat products |

3.2 |

Brazil, Paraguay |

|

Furniture |

2.5 |

South Korea, US, Slovakia |

|

Ferrous metals |

2.0 |

China, Lithuania, Germany, Ukraine |

|

Fish and fish products |

1.3 |

Vietnam, Thailand |

|

Optical, photographic, cinematographic, measuring, controlling, precision, medical or surgical instruments and devices |

1.2 |

South Korea, Germany, China |

|

Ships, boats and floating structures |

1.1 |

China, Netherlands |

|

Prepared based on data from overall results of foreign trade. Kaliningrad region. January—December, fourth quarter 2021, Kaliningrad Regional Customs, URL: https://koblt.customs.gov.ru/statistic/vneshnyaya-torgovlya-kaliningradskoj-oblasti/2021-god (accessed 11.02.2023). |

||

The two principal manufacturing sectors, the food industry and motor vehicle assembly, demonstrated varying degrees of resilience to restrictions in 2022 and the first half of 2023. Motor vehicle assembly, once a regional leader in terms of output (it accounted for 44 % of regional output and 12.7 % of national automotive production<15>), experienced the most significant decline in output compared to other industries. This reduction was largely a result of dependence on components and parts sourced entirely from unfriendly countries. Yet, agreements have been reached to date to replace previous suppliers with partners from China. The assembly of cars from Chinese brands has already begun,<16> but the establishment of mass production requires a considerable amount of time.

Meanwhile, food production, the region’s second-largest sector in terms of output in 2021 (35 %) and the largest in terms of employment (29 %; Table 3), has grown. In Kaliningrad, the sector focuses on oilseed, meat, fish, dairy and bakery goods production. Represented by the Sodruzhestvo group of companies, oilseed processing is the region’s major food specialisation, Sodruzhestvo produces vegetable oils and meal — feed additives used in animal nutrition, its principal raw material, soybeans, being sourced from South America (Table 2).

|

Production sectors |

Kaliningrad region |

Russia |

|||

|

A |

B |

C |

B |

C |

|

|

Manufacturing industries |

1.2 |

80.5 |

88.6 |

98.7 |

106.2 |

|

Foodstuffs |

3.0 |

106.8 |

97.9 |

100.4 |

105.3 |

|

Beverages |

0.6 |

84.1 |

125.7 |

103.1 |

102 |

|

Tobacco products |

1.4 |

91.1 |

81.4 |

92.9 |

103.7 |

|

Textiles |

0.9 |

66.8 |

70.7 |

91.7 |

99.1 |

|

Clothing |

0.3 |

86.8 |

76.2 |

102.1 |

105.9 |

|

Leather and leather goods |

0.4 |

77.7 |

91.3 |

98.3 |

111.7 |

|

Wood processing |

0.2 |

92.2 |

90.6 |

87.5 |

90.2 |

|

Paper and paper products |

0.7 |

67.3 |

94.6 |

100 |

97.5 |

|

Printing |

0.3 |

93.4 |

74.7 |

107.8 |

93.6 |

|

Chemicals |

0.4 |

93.1 |

118.9 |

96.2 |

102.1 |

|

Pharmaceuticals |

… |

106.4 |

64.8 |

108.6 |

92.7 |

|

Rubber and plastic products |

0.4 |

108.9 |

101 |

99.2 |

106.1 |

|

Other non-metallic mineral products |

0.5 |

106.6 |

112.8 |

99.8 |

100.1 |

|

Metallurgy |

0.1 |

84.9 |

93.5 |

99.2 |

104.9 |

|

Finished metal products, excluding machinery and equipment |

0.4 |

96.5 |

99.8 |

107 |

129.7 |

|

Computers, electronic and optical products |

1.3 |

63.2 |

129 |

101.7 |

130.4 |

|

Production sectors |

Kaliningrad region |

Russia |

|||

|

A |

B |

C |

B |

C |

|

|

Electrical equipment |

0.1 |

79.2 |

64.4 |

96.3 |

122.0 |

|

Machinery and equipment not classified elsewhere |

0.2 |

67.8 |

97.2 |

101.9 |

104.7 |

|

Motor vehicles, trailers and semi-trailers |

12.7 |

31.6 |

12.6 |

55.3 |

89.3 |

|

Other vehicles and equipment |

0.1 |

88 |

67.3 |

95.8 |

122.1 |

|

Furniture |

3.0 |

56.1 |

49.3 |

97.4 |

114.5 |

|

Production of other finished goods |

0.5 |

110 |

109.2 |

97.5 |

100.1 |

|

Maintenance and assembly of machines and equipment |

0.5 |

87.8 |

76.5 |

95.2 |

99.7 |

|

Proportion in the total Russian population, % |

0.7 |

— |

— |

— |

— |

|

Prepared based on data from production Index, EMISS, URL: https://fedstat.ru/indicator/57807 (accessed 06.08.2023) ; Kaliningrad Region in Digits, 2022,A statistical digest in two volumes. Kaliningrad : Kaliningradstat, 2022. Vol. 2 ; Kaliningrad Region in Digits, 2023: A statistical digest. Kaliningrad : Kaliningradstat, 2023 ; An Annual Russia Statistical Digest, 2022. Moscow : Rosstat, 2022 ; Average employment figures since 2017, EMISS, URL: https://fedstat.ru/indicator/58994 (accessed 30.08.2023). |

|||||

Comment: A — stands for the produce shipped, works performed and services rendered by region companies (output), % of the national total, 2021; B — stands for 2022 output, % of the 2021 level; C — is the output from January to June 2023, % of that of the first six months of 2022.

The values highlighted in bold in column A exceed the region’s share in the national population; in columns B and C, they are equal to or above 100 %. In the left column, industries associated with values equal to or exceeding 100 % in both periods (2022, January—June 2023) are highlighted in bold and those values of 100 % or above in one of the periods are indicated in italics.

A comparison of the performance of the region’s two largest organisations leads one to agree with the opinion voiced by Prof Vardomsky that Avtotor, a major motor vehicle assembly company, is in a more precarious position than Sodruzhestvo, which relies on both international and domestic demand and is capable of creating global value chains [25, p. 41]. Most importantly, Sodruzhestvo procures raw materials from friendly nations, whilst Avtotor used to ship knockdown kits and parts from unfriendly states, which discontinued the deliveries.

Other industries experiencing a dramatic decline are furniture manufacture and electric appliance production. The production of computers, electronic, and optical devices, once Kaliningrad’s third-largest manufacturing industry comprising 3 % of total regional output in 2021, plummeted in 2022 but started to recover in the first half of 2023. The decline in the furniture industry, which depends on both imports and exports, continued in 2023 (Table 2).

The proportion of manufacturing companies in the total regional employment seems to provide a clearer picture of the industrial structure than the volume of produce shipped, works performed and services rendered. Although it seems reasonable to replace the latter metric with distribution by value added generation, the author was unable to access such data. The motor vehicle industry employs fewer than 5 % of all local residents engaged in the economy, which is significantly below employment in the food industry (28 %) and some other sectors (Table 3).

|

Industry |

Kaliningrad region |

Russia |

|||

|

A |

B |

C |

B |

C |

|

|

Manufacturing |

0.72 |

100.0 |

104.3 |

100.0 |

100.3 |

|

Foodstuffs |

1.17 |

29.3 |

101.8 |

17.9 |

102.1 |

|

Beverages |

0.5 |

1.1 |

117.7 |

1.6 |

110.2 |

|

Tobacco products |

5.94 |

0.7 |

97.8 |

0.1 |

103.6 |

|

Textiles |

0.96 |

2.2 |

100.8 |

1.6 |

93.3 |

|

Clothing |

0.51 |

2.9 |

96.3 |

4.0 |

100.7 |

|

Leather and leather goods |

0.47 |

0.5 |

125.3 |

0.8 |

103.6 |

|

Wood processing |

0.52 |

4.4 |

140.7 |

6.1 |

101.0 |

|

Paper and paper products |

0.95 |

2.2 |

105.7 |

1.7 |

94.6 |

|

Printing |

0.51 |

1.2 |

111.9 |

1.7 |

92.3 |

|

Chemicals |

0.28 |

1.7 |

112.1 |

4.3 |

102.6 |

|

Pharmaceuticals |

0.41 |

0.6 |

140.0 |

1.1 |

97.5 |

|

Rubber and plastic product |

0.53 |

2.7 |

95.8 |

3.6 |

100.6 |

|

Other non-metallic mineral products |

0.68 |

5.1 |

92.4 |

5.4 |

100.1 |

|

Metallurgy |

0.12 |

1.0 |

108.6 |

5.8 |

100.1 |

|

Finished metal products, |

0.49 |

6.2 |

108.8 |

9.1 |

99.4 |

|

Computers, electronic and optical products |

0.59 |

3.7 |

99.5 |

4.5 |

102.4 |

|

Electrical equipment |

0.29 |

1.2 |

119.9 |

3.1 |

93.2 |

|

Machinery and equipment not classified elsewhere |

0.45 |

3.4 |

101.2 |

5.3 |

95.0 |

|

Motor vehicles, trailers and semi-trailers |

0.83 |

4.8 |

99.0 |

4.1 |

98.2 |

|

Other vehicles and equipment |

0.84 |

7.5 |

100.3 |

6.4 |

98.5 |

|

Furniture |

1.48 |

7.7 |

106.0 |

3.7 |

103.6 |

|

Industry |

Kaliningrad region |

Russia |

|||

|

A |

B |

C |

B |

C |

|

|

Production of other finished goods |

1.73 |

3.0 |

104.6 |

1.2 |

112.4 |

|

Maintenance and assembly of machines and equipment |

0.93 |

6.9 |

96.9 |

5.3 |

101.4 |

|

Prepared based on data from average employment figures since 2017, EMISS, URL: https://fedstat.ru/indicator/58994 (accessed 04.08.2023). |

|||||

Comment: A — stands for the proportion of those employed in the industry in the total national employment in the industry, 2021; B — stands for the contribution of the industry to the total employment in manufacturing, 2021; C — stands for the number of those employed in the industry in 2022 as the percentage of 2021 levels.

The values highlighted in bold in column A are above the proportion of the Kaliningrad region in the total national population (a 2021 average of 0.70 %); in columns B, the highlighted values are above the corresponding national average; in C, they are at 100 % and above.

The number of those employed in manufacturing as a whole increased in Kaliningrad in 2022, as was the case in most of the manufacturing industries operating in the region, the growth being more substantial than across the country (Table 3). Employment in other manufacturing industries declined slightly, from 1 % to 4 %, except for the manufacturing of other non-metallic mineral products, where the decrease was as large as 8 %. Even in motor vehicle assembly, the reduction in employment did not exceed 1 %, which was partly due to government support. The 2022 federal budget allocated 62.5 billion roubles to address issues in the labour market.<17> Growing employment means that affected businesses place hopes on restructuring and expect recovery when having forged new trade partnerships and adjusted the companies’ specialisation. Moreover, there is still room for local organisations to benefit from the introduction of innovations.

Conclusion

The abrupt change in the international factors affecting the development of the Russian economy has called for the restructuring of Kaliningrad’s manufacturing industries. Proposals for a substantial, i. e., dynamic and proportional, development of regional manufacturing industries in a complex and rapidly changing environment follow two paths.

The first group of proposals concerns changes to external ties ensuring the imports of raw materials and semi-finished products and the exports of finished goods. Such measures may include expanding connections with friendly nations and other Russian regions to compensate for the trade operations with unfriendly countries.

The second group focuses on changes to the industrial structure: downsizing some materials-intensive industries, especially those whose development would demand trading with unfriendly nations. A list of such industries and companies cannot be produced at present as each case requires an individual investigation. Yet it is worth noting that clothing and footwear production accounts for a modest proportion of production output and employment in regional manufacturing industries. This circumstance merits attention since organisations engaged in the industry flourished in the Soviet period. In the novel situation in the consumer goods market, clothing and footwear production may once again prove effective.

Except for a few general comments, the urgent problems of technological re-equipment of production facilities lay beyond the scope of this study. Nor did the research encompass the introduction of innovations into production facilities, migration and the rational use of workforce as factors in the development of manufacturing industries. Yet, the data quoted in this study on raw materials and semi-finished goods imports (Table 1), production dynamics in 2022 and the first six months of 2023 (Table 2), and changes in employment (Table 3) may help pinpoint objects for a more detailed study. Yet, preliminary conclusions can be drawn about the region’s two major manufacturing industries — motor vehicle assembly and oil production.

1. Industrial restructuring in manufacturing is closely linked to overcoming path dependence. This suggests finding solutions to development problems encountered by the industries created in conditions very different from those required for economic development today. The motor vehicle assembly industry was affected more than others. Its prospects seem inextricable from reaching out to new suppliers of parts and knockdown kits, with Chinese companies being the only viable candidates, and, more importantly, from cooperation with organisations based in mainland Russia, chiefly St. Petersburg and the Leningrad region.

2. Sodruzhestvo, whose raw materials supplies can be described as steady, should optimise its consumer geography, redirecting much of its produce to mainland Russia and Belarus.

For the meat, dairy, fish and preserves branches of the food industry, it is advisable to work towards self-sufficiency in terms of raw materials and focus on the local consumer market by creating agro-industrial clusters and developing animal husbandry, fisheries and fish farming, and crop farming, respectively.

The regional government has already embraced a cluster policy in industry. A promising measure is establishing shipbuilding and amber processing clusters designed to evolve into interregional constellations by incorporating businesses from other Baltic regions of Russia into a unified value chain. This cluster is intended to operate within the territorial system comprising St Petersburg and the Leningrad and Kaliningrad regions. There is a need to enhance collaboration amongst the three territories in the economy and social sphere by forming a multi-industry spatially distributed cluster [26]. Referred to in the recent past as a ‘window to Europe’, now they are expected to become one of the many ‘windows to the global world’.

In conclusion, the migration influx into the region continues despite the challenges in economic development due to restrictions from unfriendly states. In 2022, the net migration rate reached 60 people per 10,000 residents.<18> The population of the region is increasing due to immigration, making it possible to address the staffing needs of new and restructured production facilities.

This study was supported by the Russian Science Foundation within project № 22-27-00289 Providing a Rationale for International Ties Restructuring and Measures to Ensure Military-Political Security in Russia’s Baltic Regions Amid Growing Geopolitical Tensions.