The border as a barrier and an incentive for the structural economic transformation of the Kaliningrad exclave

- DOI

- 10.5922/2079-8555-2023-4-6

- Pages

- 104-123

Abstract

This paper aims to study how geopolitical shifts affect regional economies and their structures. Border functions and regimes act as tools for the economy and society to adapt to the redistribution of political influence, movements of people, goods, capital and information between integration associations, individual countries and their cores. A changed environment may slow down the development of some industries (and even cause them to decline) and give a boost to others, with these two processes constituting economic restructuring. In the exclave of Kaliningrad, heavily dependent on international trade and transit trade with mainland Russia, geopolitical changes have naturally had an exceptionally strong effect. The relationship between border functions and economic restructuring was investigated over four periods. The study utilised data from Rosstat and the Federal Customs Service, departmental statistics and findings from expert interviews conducted by the authors. The extent and direction of changes are assessed by examining the ratios between major economic sectors, the structure of foreign trade relations, and the volume and sectoral distribution of investments. Four main ways are identified in which the sharp increase in the barrier nature of the borders between the Kaliningrad region and neighbouring countries since 2014 and especially February 2022 has influenced the region’s economy. The significance and effectiveness of the agro-industrial complex have risen, with an increased focus on domestic tourism, and the adoption of advanced public administration practices in collaboration with businesses. This includes implementing mechanisms such as Free Economic Zones and industrial parks, along with a shift towards proactive measures to adapt to the changing environment.

Reference

Introduction and problem setting

There are arguably few territories in Russia and abroad whose geopolitical situation has undergone such substantial and rapid changes over the last three decades as the Kaliningrad region. Russia’s Spatial Development Strategy 2025 rightfully designates this region, alongside Crimea, the city of Sevastopol, and the Far Eastern regions, as priority geostrategic territories of the nation.

The westernmost region of Russia stands as its sole and the world’s most populous exclave. The geographical isolation of the region from the main territory of the country necessitates transit through foreign countries during the overland transport of goods between the territory and mainland Russia. This circumstance objectively amplifies the role of external connections in the region’s developmental landscape.

The accession of neighbouring countries, Lithuania and Poland, to NATO and the EU in 2003—2004 further complicated interactions between the region and other Russian territories as they are now determined by not only bilateral agreements but the entire spectrum of relations between Russia and the Western community.

In this study, our objective is to analyse the effects of geopolitical shifts and resulting changes in border functions and regime on the Kaliningrad region’s economy, its structure, and its ability to adapt to new challenges. Additionally, we aim to explore options for restructuring the region’s economic and territorial framework, drawing from insights gained from past crises.

Literature review and state of research

Border studies are a dynamic and evolving interdisciplinary field of academic inquiry with a strong theoretical framework. A comprehensive review of this field is available in [1]. The contemporary paradigm conceptualises state borders, much like any other formal demarcations, as dynamic social institutions. Notably, these institutions are not static lines but rather variable entities receptive to the ever-changing international landscape, bilateral relationships, currency exchange rates, global price structures, the daily practices of political institutions, cross-border interactions, and media narratives [2]. This process has been denoted as ‘bordering’ in the English literature.

In most cases, delimitation occurs smoothly, striking an ‘equilibrium’ between the influences exerted on border functions by various stakeholders: national, regional, and local authorities, as well as communities, businesses, NGOs, and media outlets.

Conversely, changes in the geopolitical status of a territory, such as the accession of an adjacent country into an economic union, precipitate abrupt shifts in the nature of the geographical neighbourhood, which, in turn, result in a reconfiguration of political influence, the flow of goods, capital, tourists and information between integration associations, countries, and their centres. The functions and regimes of borders, therefore, operate as instruments facilitating the adaptation of both the economy and society to this altered landscape. In response, the state may reinforce the barrier nature of borders by modifying visa requirements and customs regulations, thereby impeding the free movement of citizens, or even going as far as closing the border. Alternatively, state policy may involve the relaxation of border restrictions and the reallocation of border functions as a result of political integration, as witnessed in the case of the Schengen Area. Border adaptation is not the exclusive domain of the state: regional and local authorities, for example, may foster or curtail ties with partners on the other side of the border. Simultaneously, citizens adapt the purposes and frequency of travel to neighbouring countries in response to evolving border regulations, economic dynamics, and the cross-border difference in prices of goods and services [2].

Economic entities also tend to adapt to the new geopolitical situation and border regimes. Altered external conditions cause some industries to decline and others to burgeon, bringing about a restructuring of the economy. These transformations will cause further, thought-out rather than erratic, adaptation of border functions and regime to the new circumstances with a view to launch desired processes and mitigate the consequences of the changes.

The adaptation of a region to a dramatically new geopolitical landscape has been the focus of much research. The most relevant studies draw on the theory of exclaves — territories whose geographical situation predetermines their economic and sociocultural isolation and necessitates tailored support measures [3, p. 297—319]. A number of studies examine the transformation of border functions in Crimea after 2014 and how the population and the economy adapt to this process [4], [5]. These and other works describe a wide range of tools for a successful adjustment of a border’s contact functions in this and similar cases, including special legal regulations, preferential treatments for businesses, various forms of cross-border cooperation, etc.

The way delimitation affects the restructuring of an economy can be clearly seen in the case of the Kaliningrad region. Here, ‘restructuring’ refers to industries becoming habituated to the changing competition environment, new facets of market demand, and government regulation [6], [7]. This is a response to both minor shifts and qualitative transformations facilitating the adaptation of an economy to new conditions. The scope and direction of structural shifts are usually assessed by analysing capital markets, namely the volume of investment and its breakdown by industry, the contribution of each sector, and the geographical structure of international trade relations.

Several works depict the restructuring of an economy as a highly irregular process contributing to growing territorial contrasts and modifying the socio-economic space (see, for example, [8]). This evolution can be represented as a sequence of consecutive states, each revealing a period-specific spatial pattern of external and internal hierarchical interactions [9]. Globalisation, in which the Kaliningrad region actively participated in the early years of the new century, involved the creation of long-distance connections, leading to the emergence of a global financial centre hierarchy to manage these ties.

The resilience of territories of different types to crises relating to susceptibility to innovations and predisposition to positive structural changes traditionally garners significant attention from experts in social geography and regional economics. One of the most well-known concepts, which builds to a large extent on the findings of the American Douglass North and the Russian Rustem Nureev, is that of path dependence, which posits that the previous economic performance of a region or country puts constraints on future development trajectories [10, [11]. In the post-Soviet years, overcoming path dependence was a pressing concern for the region, which strived to take advantage of opportunities and mitigate the limitations imposed on its economy and society by the continually changing geopolitical situation [12].

The history of Kaliningrad as a Soviet and Russian region can be divided into several periods, further subdivided into stages, depending on the intensity and nature of its connections with the neighbours (see, for example, [13], [14], [15]). In the context of this research, the most pertinent classification is the functional-temporal typology of the Russian-Polish and Russian-Lithuanian borders undertaken by Lidia Gumenyuk [13], which is grounded in the established concepts of Oscar Martinez and his followers. In contrast to Gumenyuk, we consider one of the recent post-Soviet periods to end not in 2012, when the Small Border Traffic (SBT) regime was introduced between Russia and Poland, but in 2014 when the barrier function of the region’s external borders became much more pronounced amid Western sanctions against Russia imposed after the incorporation of Crimea. Nor do we view the years 2020—2022 as a separate stage distinct from the period starting in 2016, when Poland terminated the SBT: the ‘temporary’ border closures during the pandemic quickly transformed into formidable barriers due to the subsequent rupture between Russia and the West.

The study uses three groups of sources. The first includes statistics from Rosstat, the Federal Customs Service, and executive bodies. Analysing this data is complicated by changes in the methodology for treating socio-economic indicators. For example, investigating structural transformations of the economy required a comparison of data from different classifiers: the Soviet OKONKh (All-Union Classifier of Industries of the National Economy) and the Russian OKVED-2007 and OKVEDd, OKVED standing for All-Russian Classification of Types of Economic Activities. Although the accuracy of such conversion is far from perfect, as a number of works have demonstrated [16], [17], it helped perform an assessment of the most significant structural shifts. The second group of sources used in this study comprises the findings of the field studies that we conducted from the early 2000s (see [18] for more detail). The most recent data were collated in May—June 2002 by conducting 24 expert interviews with representatives of regional and federal authorities, businesses, academic and expert communities, and NGOs. The interviews were held in the Kaliningrad region and district centres. The third group of sources is basic research carried out by colleagues from Kaliningrad [12], [15], [19], [20], [21], [22], [23], [24], [25] etc.

Border regimes and the crisis of transition: synergy effects as seen in an exclave (1991—2003)

The legal status and regime of the Kaliningrad region’s borders first changed in September 1991, when the USSR recognised the independence of the Baltic States. In the summer of 1992, Lithuania introduced a visa regime for travellers from Russia, which was followed by the establishment of economic barriers, including the implementation of border and customs controls, and the imposition of trade tariffs. As a result, cross-border movement of goods became slower and more costly [22], [23]. At the time, up to 70 % of the region’s output was exported to other parts of the country, whilst many local industries received raw materials and components from mainland Russia and third countries [20].

These events further exacerbated the effects of chaotic privatization and the disorganization of the economy, leading to the near-complete collapse of the region’s previously dominant cross-industry fishing sector, which accounted for 12 % of the country’s fish and seafood catch and 33 % of the region’s industrial output. The crisis also affected machine engineering, which, comprising 28 % of industrial production, primarily served the interests of the fishing sector and the military [20].

Located in the western part of the USSR, the Kaliningrad region was one of the USSR’s strongholds. It housed one of the bases of the Baltic Fleet, numerous garrisons, and military airfields. The concurrent radical downsizing of the military dealt another blow to the region’s economy.

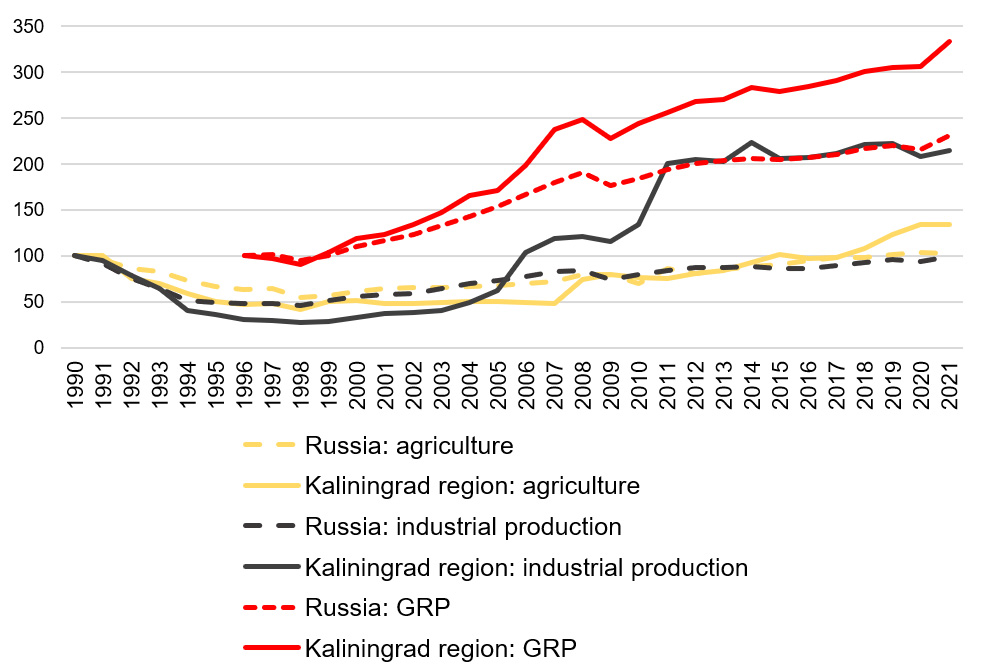

A comparative analysis of national land regional macroeconomic indicators leads one to conclude that the economic decline was much deeper and faster in Kaliningrad than across Russia (see Fig. 1). By 1995, industrial production had fallen to 40 % of the 1989 level (compared to the national average of 51 %). As for the sectoral structure, there was a noticeable reduction in the proportion of machine engineering, the food industry and the textiles, clothing, leather and footwear sectors. The increase in the share of the fuel industry and energy in the same year to 13.9 %, compared to 1.3 % in 1989, was a mere symptom of the crisis. Both sectors were in deep recession: oil production suffered from the increasingly complicated process of selling oil to the Mažeikiai refinery in Lithuania, whilst the power industry struggled to obtain electricity from the neighbouring state. Economic contraction continued until 1998. The standards of living in the region were markedly below the national average.

|

| 1 |

| Macroeconomic indicators, % of 1990 level (1996, for GRP) |

|

Source: compiled by the authors based on Rosstat data.<1> |

The adaptation of the region’s population and economy to the new conditions was considerably eased by lowering the border barrier between the territory and Poland. Novelties such as shuttle trading and intermediary businesses, which largely contributed to the shadow economy, ensured the influx of inexpensive consumer goods. Economic rent due to the proximity of the border allowed residents of the region’s border districts to partially offset the decline in their living standards [19], [25].

An important mechanism helping the economy adapt to the new geopolitical environment was state support, namely the Special Economic Zone (SEZ) regime established in 1996 (SEZ-1996). This regime allowed for duty-free import of foreign raw materials and semi-finished products and the export of the resulting products to the mainland, provided a certain level of value-added, ranging from 15 % to 30 %, was achieved. The rouble devaluation in 1998 increased the attractiveness of this business model for entrepreneurs [14].

The economic shifts that occurred in the Kaliningrad region in the first post-Soviet decade are more accurately described as a structural crisis rather than a restructuring. The main outcomes were the downsizing and, in some cases, complete closure of Soviet-era industries. They were replaced by the involvement of the surviving economic actors in international speculative trade in the interest of major global players. Nevertheless, local businesses, including small and medium-sized enterprises, accumulated unique experiences and competencies in dealing with counterparties in the global market.

Border position and border regimes as tools to adopt to a changing geopolitical environment and their role in economic restructuring (2003—2014)

A secondary effect of the 2004 EU enlargement was the Polish-Russian border increasingly emerging as a barrier: now Kaliningraders needed a visa and an international passport to visit the neighbouring country. As early as 2003, the number of crossings of the Russian—Polish border dropped by 20 % compared to 2002; in 2009, the decline was already by a factor of three [26]. Yet, the new metamorphosis of the borders did not lead to any crisis phenomena in the regional economy. On the contrary, from 1999, Kaliningrad’s GRP was growing at a rate above the national average, and the margin by which the exclave outpaced an average Russian region continued to increase in the following years (Fig. 1, p. 109). The SEZ mechanism and border permeability to some types of goods prompted the creation of new businesses, which came to account for about 70 % of the region’s industrial output and 25 % of GRP. Imported components and technology were used to manufacture the bulk of consumer goods on the Russian market [18]. According to Rosstat, in the mid-2000s, the region accounted for 86 % of televisions and 84 % of vacuum cleaners produced in the country. The automobile assembly company Avtotor was rapidly developing. Statistical analysis shows a phenomenal growth in the contribution of machine engineering in the industrial structure of production according to the value: from 10.6 % in 1995 to 37.1 % in 2004. The proportion of the food industry also increased, having exceeded 30 %. This rise could be attributed, to a large extent, to the launch of new soybean processing facilities

(Table 1). The region was making headway towards overcoming path dependence.

|

Industry |

1989 |

1995 |

2001 |

2004 |

2008 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Electric power industry |

1.3 |

13.9 |

9.8 |

5.8 |

6.3 |

5.6 |

6.0 |

7.0 |

7.4 |

7.7 |

|

Petrol industry |

1.2 |

6.8 |

20.4 |

10.2 |

6.8 |

3.6 |

2.9 |

2.8 |

2.3 |

2.6 |

|

Chemical and petrochemical industry |

0.8 |

0.5 |

0.3 |

1 |

1.9 |

3.5 |

4.1 |

3.5 |

1.1 |

3.4 |

|

Mechanical engineering and metal processing |

27.9 |

10.6 |

19.6 |

37.1 |

52.2 |

42.9 |

47.6 |

48.9 |

45.9 |

45.0 |

|

Forestry, wood processing, and pulp and paper industry |

10.8 |

21.3 |

13 |

7.4 |

3.1 |

4.9 |

4.1 |

3.4 |

3.3 |

1.9 |

|

Construction materials industry |

2.6 |

2.7 |

1.3 |

2.7 |

1.7 |

2.5 |

1.4 |

1.4 |

1.5 |

1.2 |

|

Textiles, clothing, leather and footwear sector |

4.9 |

2.3 |

1.7 |

1.7 |

2.0 |

0.7 |

0.6 |

0.5 |

0.5 |

0.4 |

|

Food industry |

44.8 |

32.9 |

30.3 |

31.7 |

21.8 |

31.6 |

27.6 |

27.5 |

29.3 |

32.1 |

|

Other |

5.7 |

9 |

3.6 |

2.7 |

4.5 |

4.8 |

5.6 |

5.0 |

9.0 |

5.5 |

|

Source: compiled by the authors based on Rosstat data.<2> |

||||||||||

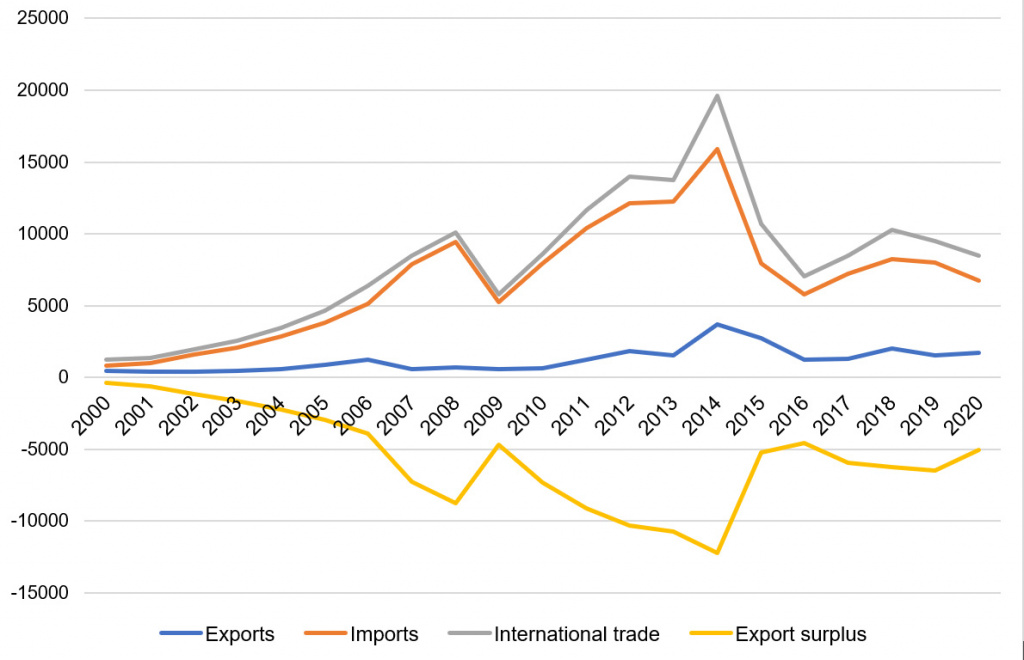

Import substitution was inextricably linked to the continuing explosive growth in international trade, where partners from Germany, South Korea, Poland and China had a central role. Between 2000 and 2004, international trade increased by a factor of 2.8; by 2008, it had reached a level eight times that of 2000. Import operations significantly surpassed export operations: the difference was twofold in 2000, fivefold in 2004 and as large as fourteenfold in 2008 (Fig. 2).

|

| 2 |

|

Changes in the key international trade metrics in the Kaliningrad region, USD million |

|

Source: compiled based on Rosstat data.<3> |

The adaptation of Kaliningrad borderlands to the new geopolitical landscape, status, and border regime emerged as the focus of the EU’s regional interest. By 2003, Euroregions had become viable platforms for cross-border collaborations, with the region involved in more of these cooperation structures than any other Russian territory. In 2004, when Lithuania and Poland acceded to the EU, participants from the two countries gained access to the financial instruments of the INTERREG programmes, whilst their Russian counterparts could now benefit from TACIS funding. Despite unequal financial opportunities and hence actual results, the programme was conducive to overcoming distrust between the neighbours.

An important step towards stronger cooperation was the conclusion of an agreement on local border traffic (LBT). Poland had lobbied the European Commission for expanding the LBT zone beyond the standard 50 km range [27]. As early as 2013, 3.5 million border crossings were carried out under the LBT regime, which gave a boost to the economies of Polish voivodeships abutting the border with Russia [18], [28].

A new programme, titled Poland—Lithuania—Russia, was launched in 2007. Co-financed by the Russian Government, this initiative paved the way for a more equal cooperation whilst securing a more generous programme budget. Dense networks of years-long partnerships had helped build a foundation of trust and understanding, which made it possible to downplay the barrier properties of the national border.

Despite the successes in overcoming path dependence, economic restructuring remained a major concern to the federal and regional authorities, along with a heavy dependence on external markets, currency exchange rates, current relations with the EU and, therefore, border functions and regimes [29]. The global crisis of 2008—2009 highlighted the precarious state of the economy of the region where the decline in GRP and international trade was more considerable than across the country (Fig. 1).

In 2006, the SEZ-1996 regime underwent extensive reforms. These changes were driven not only by the fragile economic situation but also by the push for closer Eurasian integration, Russia’s accession to the WTO, and the concerns of producers from the country’s mainland regions. According to the new federal law on SEZ in the Kaliningrad region, which came into effect on 1 October 2006 (SEZ-2006), customs privileges were set to be replaced with tax benefits, starting from 2016. During this ten-year transition period, only SEZ-1996 residents registered before 1st April 2006 could continue to benefit from the old rules. Simultaneously, substantial efforts were undertaken to bolster energy security in the region. From 2002 to 2010, two energy blocks were brought online at the Kaliningrad Thermal Power Plant, and in 2013, an underground gas storage facility was established [30]. Additionally, between 2004 and 2007, ferry services commenced operations between the ports of Baltiysk and Ust-Luga.

2014—2020: sanctions and countersanctions, new functions and regimes of borders, economic adaptation and restructuring

The 2014 geopolitical crisis caused by the Ukraine events led to a dramatic deterioration of relations with the EU. A harbinger of a new stage of restructuring of the region’s economy was the transformation of international trade. Sanctions imposed by the EU and Russia’s countersanctions changed the border regime for international trade flows, which dwindled in the second half of 2014. The rouble plummeting in response to falling oil prices and other factors further aggravated the situation. The region’s international trade decreased by a factor of 1.8 in 2015 and again by 1.5 in 2016. This decline was mostly accounted for by imports, which decreased by two times in 2015 and 1.4 times a year later. All this reduced the negative balance of trade.

As the nature of neighbourhood with EU countries changed and the borders started to act as barriers, the geographical and commodity structure of international trade altered as well. For example, agricultural produce accounted for 30—45 % of exports in 2014 and as much as 74 % in 2016. Soybean and rapeseed oil comprised about half of agricultural exports; waste oil, wheat, and maslin, another 20 %. The geography of exports was changing as well, in response to the volatility of food markets and the situation where the fluctuating rouble exchange rate compelled contracting parties to opt for large but one-time export contracts in shipbuilding and electronics at the end of 2014. In 2013, the region’s major export partners were India (26 %), Lithuania (12 %) and Norway (8.6 %); in 2015, Germany (53 %), Algeria (5 %), and Norway (4.7 %); in 2016, Norway (11.1 %), Algeria (10.4 %), Germany (6.2 %), Lithuania (6 %) and Poland (5.8 %).

As before, the bulk of imports consisted of machinery and equipment, comprising 40—50 % between 2015 and 2016, knockdown kits for Avtotor, and electronic and electrical components. The share of agricultural products increased from 18 % in 2014 to 31.6 % in 2016. Soybeans, used as the primary raw material for the Sodruzhestvo-Soya plant, accounted for nearly two-thirds of the agricultural imports. Sanctions and the severance of ties with European partners led to an increase in the share of imports from countries lying far beyond the Baltic region, including China (12.3 %), Korea (10.8 %), Brazil (10.4 %) and Paraguay (7.8 %).

In 2015, the region’s GRP decreased by 1.5 %, and industrial production dropped by 7.8 %, compared to Russia’s respective – 0.6 % and – 3.4 % decline. The most significant decrease was observed in the automotive industry, where the output halved, and in the production of electronic and optical equipment (by 40 %). The production of sausage products, meat, and fish preserves, which relied on raw materials from the Baltic States and Poland, also suffered.

A new period of the region’s adaptation to the evolving geopolitical and geo-economic environment began in 2014, and its borders with EU countries started to assume new functions and meaning. From 2016 to 2019, the region’s economy continued to develop faster than that of an average Russian region, at a mean rate of 2.3 %. However, its industrial sector grew at a more modest pace of 0.9 % to 1.8 %, experiencing a five per cent increase only in 2018.

In Kaliningrad, similar to several other Russian regions, agriculture underwent significant adaptation to emerge as one of the primary beneficiaries of restrictions on European agricultural imports, leading to substantial adjustments [31]. The region’s food self-sufficiency increased dramatically: agricultural production saw a 10 % growth per year in 2015 and 2016, accompanied by 7—10 % annual increases in crop areas, livestock, poultry stock, milk (16.2 %), and egg production (17.8 %). Regional authorities actively supported agribusiness with subsidies and concessional loans [32]. Regional authorities actively supported agribusiness with subsidies and concessional loans [32]. The investment boom in the industry was associated with both the expansion of production by regional holdings and companies, including Dolgov Group, Food Products Group, Zalesye Agro-Industrial Complex, Orbita-Agro, and the arrival of agro-holdings from mainland Russia, such as Miratorg. According to Rosstat, between 2013 and 2019, there was a 49 % increase in crop areas, which resulted in a doubling of grain harvest, a 20 % rise in vegetable output, and a 50 % surge in berry production. Simultaneously, agricultural production efficiency increased significantly. For example, annual milk yield per cow rose from 5,486 to 7,771 kg (8,552 kg in 2020) during the same period, whilst grain yield increased from 3.84 to 5.2 tons per hectare — a level comparable to the performance of some black soil belt regions.

The overall shift in the geopolitical situation of the Kaliningrad region, as well as Russia as a whole, pointed in one clear direction: a worsening of relations with European and Western partners, particularly Poland and Lithuania. In contrast to previous stages, urgent preventive measures were taken to adapt to the exclave’s borders increasingly turning into barriers. Among other initiatives, the construction of a gas terminal and the Marshal Vasilevsky floating storage and regasification unit was completed in 2015. Four new gas-fired power plants were commissioned between 2018 and 2019, leading the region to enjoy an energy surplus. In 2018, the construction of two new ferries in addition to the two existing ones began [18].

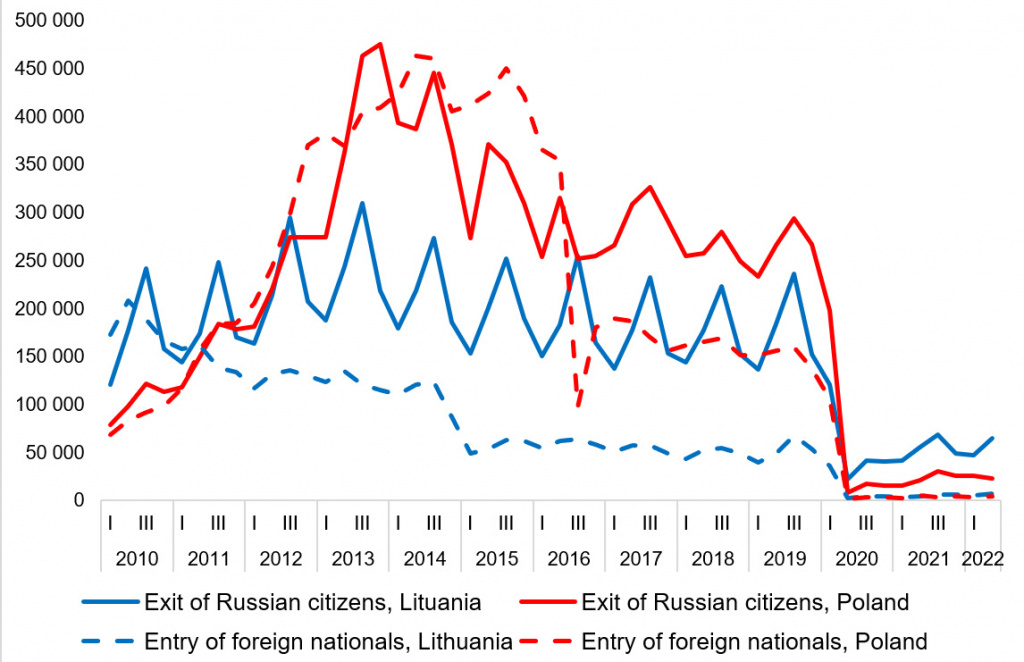

The termination of the LBT regime by Poland and the crisis in cross-border cooperation served as clear symbols of the increasing barrier nature of the border. By the end of 2016, the number of crossings of the Russian—Polish border had already decreased to the level of the early 2000s. Cooperation within such important institutions as the Council of the Baltic Sea States and the Northern Dimension was frozen, and the projects launched in 2007—2013 and completed in 2014 experienced difficulties in receiving final payments.<4>

Global-regional crises as a factor in the new radical restructuring: 2020 onwards

The new restructuring of the border resulted from a clash of two unrelated global crises, whose consequences, however, were closely intertwined. The first one was the COVID-19 pandemic, the second was a fresh round of confrontation between Russia and the West, triggered by the commencement of a special military operation in Ukraine.

The closure of the Polish (13 March 2020) and then Russian and Lithuanian (14 March) borders after the start of the pandemic hit the entire spectrum of humanitarian contacts [33] and cross-border cooperation. According to the Polish Border Guard, the number of border crossings with Russia barely exceeded 740,000 in 2020 and decreased 5.3 times compared to 2017 and 8.8 times compared to the record-breaking 2014.

The effect of the pandemic felt worldwide was aggravated in the region by local factors: high cross-border mobility of Kaliningraders, which predetermined rapid growth and high peaks of morbidity, the dependence of the economy on external links, and the collapse of cooperative ties. External and internal pandemic-related restrictions, complicated logistics and, especially, lockdowns and the ensuing drop in consumer demand disrupted operations in the automotive industry, electronics, and many branches of the service sector. Foreign engineers and workers could not come to Kaliningrad, which caused delays in the implementation of projects in the food, electronic, automotive, and furniture industries.

The first relaxation of the restrictions was made only in June and August 2020. In February 2021 railway transit through Belarus and Lithuania was restored. However, the region’s land borders remained mostly closed until 15 July 2022.

|

| 3 |

| The number of crossings of the Russian—Polish and Russian—Lithuanian borders by Russian and foreign citizens<5> |

|

|

The closure of borders brought about painful lifestyle changes for many Kaliningraders who were compelled to forsake their familiar consumer habits closely linked to travel to Lithuania and, particularly, Poland. Another victim of the restrictions was the business of shuttle traders who both satisfied the high demand for certain Russian goods procurable in the Kaliningrad region, such as fuel, tobacco and alcohol, and supplied the region with European products, including the foodstuffs covered by Russian sanctions. The flip side of the border closure was the diversion of this additional demand to the products of the regional agro-industrial complex. The closure of the border, however, contributed to growing demand for the products of the regional agro-industrial complex.

The pandemic-indued global economic crisis, to which the region’s economy and society had not yet fully adapted, turned into an even more serious and long-term crisis associated with the special military operation and unprecedented Western sanctions against Russia. The region’s dependence on imports, measured as the share of imports in local enterprises’ expenditures on services, raw materials, materials, semi-finished products, and components for production and sales, was the highest among all Russian regions, reaching 76.5 % between 2019 and 2021 [34]. As shown by Olga Kuznetsova, the sanctions had a particularly strong impact on regions with a high proportion of foreign capital in the economy, investments from unfriendly countries, and a specialisation in the automotive industry [17]. The convergence of these three factors caused the Kaliningrad region to experience a record decline in production from 2020 to 2022, unseen in the rest of the country. There are four primary ways in which the sanctions have affected the socio-economic situation in the region.

The first, most sensitive group includes transport and logistics difficulties. In April 2022, Russian ships were banned from entering EU ports, and the only company that continued feeder service to Kaliningrad ports was the Chinese COSCO. Increasingly thorough checks at the border with Lithuania starting in March created long queues at road border crossing points and reduced the number of wagon turnovers per month. Russian and Belarusian road haulers were banned from operating in the EU, trucking being one of the region’s specialisations. In June, with reference to the general requirements of the EU and in violation of transit agreements, Lithuania closed the transit of sanctioned products through its territory, including construction cargoes. At the end of the year, the transport of fuel was discontinued as well. The counter-sanctions also had an impact. For example, the Belarusian authorities, in response to the European sanctions, banned foreign carriers from operating on their territory, which required the transshipment of goods when entering and leaving the country.<6>

The wagon turnover problem was partly solved by establishing a regional transport company: Novik Group was granted a loan for creating a wagon fleet of its own. The capacity of the ferry service was also increased. Whilst in February 2022 only two ferries operated on the line, in April 2023 it was served by four railway ferries, a RORO vessel, and two multi-purpose dry bulk carriers. Overall, 18 vessels provided supplies to the region on an irregular basis. In the next few years, it is planned to build a new terminal and increase the total number of ferries to ten. In addition, several customs clearance regulations have been changed specifically for the region to ensure a quick response to the changing situation at land borders. Nevertheless, in the absence of an alternative, ferry transport made logistics more expensive.<7> Cargo distribution is imbalanced: ferries to the Kaliningrad region run fully loaded, whilst the cargo volume in the reverse direction is considerably lower.

The problems of transport and logistics are closely interconnected with restrictions on technology imports and trade. The ban by the US and European countries on trade with Russia in dual-use products, machinery and components containing know-how patented or manufactured in Western countries dealt a serious ban on Avtotor. In 2019, Avtotor’s cargoes accounted for about half of Kaliningrad Railway’s traffic, 71 % of the container transshipment of the Kaliningrad Commercial Sea Port, and 74 % of the Baltiysk Sea Terminal.<8> The decline in production at this enterprise alone could not but lead to significant problems in the transport sector.

In February 2023, however, Avtotor signed a multilateral agreement with six Chinese companies. In March 2023, manufacturing of the saloon Kaiyi E5 began. The company’s management expects its 2023 production to range from 70,000 to 100,000 cars. For comparison, Avtotor, whose total capacity is 250,000 cars per year, produced about 140,000 cars in 2017.

Companies involved in electronics and the manufacturing of other innovative products have also encountered significant problems. To illustrate, the routine setting of numerical control machines requires one-time access codes from the manufacturer, which have been denied by some companies. Similar problems with setting up equipment are experienced by food enterprises. For instance, Russia’s sole whisky distillery, constructed with Italian machinery in Chernyakhovsk, has remained non-operational for nearly two years.<9>

The financial restrictions have also aggravated the situation in the import-dependent region. The rouble’s nosedive in February—March 2022, the withdrawal of international payment systems from Russia and the SWIFT ban against many Russian banks forced entrepreneurs to look for intermediaries in friendly countries to make payments. They found assistance in Serbia, Turkey and China, whilst taking advantage of business opportunities in EAEU countries. Another complication is that the region’s transport flows are centralised through mainland Russia, via which the bulk of sanctioned goods transit is carried out.

The fourth sanction area is the complete suspension of cross-border cooperation between Russia and the EU. Steps taken in this regard include the refusal to prepare new programmes for 2020—2027, the severance of twin city ties and other connections, and the termination of participation in 2014—2020 cooperation programmes, which were to be officially completed only on 31 December 2022. By June 2022, only 13 out of 69 projects had been completed. A challenging situation arose with major infrastructure projects, such as the reconstruction of water supply and sewerage systems in Guryevsk, Gusev and Chernyakhovsk, which could not be abruptly aborted. As a result, regional and federal financial resources had to be mobilised to solve this problem.

Most of the experts we interviewed still find it difficult to provide a detailed picture of the trajectories along which the restructuring of the region’s economy will proceed in the new geoeconomic and geo-economic environment. The likely responses are import substitution and attempts to redirect trade towards friendly Asian countries. Avtotor, for instance, is looking for new partners in South-East Asia, first of all, in China, whilst planning to start production of its electric cars in 2023—2024 in co-operation with one of the subsidiaries of the Rosatom state corporation. Other manufacturers are adopting similar tactics. Food and furniture companies are looking for suppliers and equipment from mainland Russia, China, and Turkey. Often, they have to settle for raw materials of lower quality, albeit procured at higher prices. Many enterprises, such as furniture companies, have completely switched to the Russian market, having lost direct contracts with European manufacturers, which not only offered better prices than mainland Russian companies but also provided technological advantages. As Evgeny Perunov, President of the Kaliningrad Furniture Makers’ Association, so vividly put it: ‘I say to all our manufacturers: forget that there is such a thing as Europe! Imagine that you’ve woken up and Europe is no longer there!’<10>

In agriculture, entrepreneurs, supported by regional authorities, are planning to invest in seed and livestock breeding. A pedigree bull breeding company has been established, and approximately ten breeding farms are already in operation. However, like other Russian territories, the region is experiencing difficulties with replenishing its egg-laying chicken stock, which used to be supplemented through purchases in Europe [31]. These purchases are to be replaced with domestic production, making the region a centre of agricultural breeding and genetics.

The tourism industry, one of Kaliningrad’s specialisations, has a pivotal role in the structural reorganisation of the region’s economy. The closure of the Russian borders in 2020 contributed to the boom in the industry, which began between 2015 and 2019. The regional Ministry of Tourism estimated that in 2014, there were 600,000 visits to the area, and these numbers increased to approximately 1.3—1.5 million in 2017 and 2018.<11> In 2021, after the removal of the most stringent sanitary restrictions, an all-time high of 1.9 million visits was achieved.<12> However, prices for hotel services, rented accommodation, and food increased over this period, especially in the city of Kaliningrad and the seaside resorts. Kaliningraders had no opportunity to holiday in neighbouring countries, whilst increasingly expensive local resorts became overcrowded with tourists from mainland Russia [35]. As a result, both the local residents and, later, tourists shifted their focus to the eastern part of the region, visiting towns like Gusev, Chernyakhovsk, and Zheleznodorozhny.

This growing interest paralleled the development programme for the east of the region, under which many towns boasting a rich cultural heritage are being renovated. The regional authorities managed to pool the resources of the Capital Repair Fund, grants from federal ministries, funds from charitable foundations and private investors to restore cultural heritage sites, reconstruct entire streets, etc.

Regional authorities and businesses expect government—business partnerships and the preferences received by the region to yield tangible results. Although the region continues to take advantage of the well-tested SEZ mechanism, hopes are also being placed on industrial parks, which are already making a noticeable contribution to the structural reorganisation of the economy. To illustrate, the Khrabrovo Industrial Park has brought about a change in machine building; Ecobaltic, in the local pharmaceuticals industry; the Baltic Industrial Park, in construction materials manufacturing and chemical production; Technopolis GS, in high-tech electronics; Danor, in engineering services. Since 2018, the special administrative district on Oktyabrsky Island has registered about 100 companies from foreign jurisdictions, with a combined investment of 60 billion roubles.<13>

Conclusion

The dramatic geopolitical changes in Europe and other parts of the world, such as the collapse of the USSR, the eastward expansion of NATO and the EU at the expense of former socialist countries, the acute conflict between Russia and Ukraine, Russia and the West, could not by trigger radical transformations across the global border system. The functions and regime of Russia’s borders with the EU countries were constantly changing: one day, they would become more open and contactable, creating opportunities for joint cross-border cooperation and the development of new forms of partnerships; another day, they would emerge as barriers. After 2014, the barrier function started to prevail over the contact function.

Border functions and regimes are important instruments helping economies and societies to adapt to geopolitical shifts, new world market conditions, and changing political and economic relations between countries both at the national (sometimes, as in the case of the EU, supranational) and regional levels. Bordering theory sees the adjustment of the functions and regimes of the border system as a continuous process.

The Kaliningrad exclave, a territory heavily dependent on international trade and transit trade with mainland Russia, was particularly affected by geopolitical changes. After the shock and acute crisis of the 1990s, attempts to utilise the advantages of the region’s border position began to bear some fruit: Kaliningrad outpaced other Russian regions in terms of GRP growth rates and some other metrics. The intensification of foreign trade and the promotion of cross-border cooperation, which were facilitated by simplified border crossing procedures, became crucial mechanisms for the region’s economy to adjust to the changing geopolitical and geo-economic landscape. These measures aimed to encourage the restructuring of the economy and overcoming path dependence. However, the deteriorating relations between Russia and the West, global instability and crises quickly revealed the fragility of a highly import-dependent economic system.

A lesson was learnt from the negative experience of the Kaliningrad region’s exclavisation due to the EU enlargement and the Union’s reluctance to take into account Russian interests, which was conspicuous in the late 1990s and early 2000s. A transition was completed from reactive measures to adapt the region’s economy to the changing geopolitical landscape to preventive measures, which made it possible to mitigate the negative consequences of sanctions and counter-sanctions. The region’s energy, transportation, and food security were bolstered. Moreover, the subsequent de facto closure of the region’s external borders, first in response to the pandemic and then due to Western sanctions, encouraged attempts to convert the region’s dwindling dependence on external ties into accelerated structural reorganisation and sustainable development of the economy, followed by a radical transformation of the geography of international cooperation.

Despite the considerable difficulties, the Kaliningrad authorities and businesses have shown flexibility in adapting to the current circumstances. Valuable lessons have been learned from the previous decades: the region has got experience of working with neighbouring countries and on the world market, whilst embracing programme and project approaches through cross-border cooperation with EU countries. ‘Thanks to the experience gained in cross-border cooperation programmes, we have learned how to prepare high-quality grant applications. The use of different funding sources in solving complex problems is a necessary skill within cooperation programmes. We prepare projects in advance, long before the competition is announced. We know exactly what we want to do, and then we just adapt the application to the terms of the grant,’ said in the interview an official from the Chernyakhovsky municipality.<14>

It is too early to assess successes and failures at this challenging historical moment. Although it is difficult to make forecasts and draw up detailed plans in conditions of uncertainty, the strategic objectives are clear: overcoming critical dependence of certain industries and enterprises on imports, developing high-tech industries, and ensuring more active participation in the national division of labour.

The study was supported by Russian Science Foundation project № 22-17-00263 Effects and Functions of Borders in the Spatial Organization of Russian Society: Country, Region, Municipality. Data analysis for 1991—1993 was carried out as part of assignment AAAA19-119022190170-1 Problems and Prospects of Territorial Development of Russia in the Conditions of its Unevenness and Global Instability.