Geography of the mobile internet in the border and interior regions of Russia

- DOI

- 10.5922/2079-8555-2023-3-8

- Pages

- 140-166

Abstract

Digital transformation of socio-economic processes is the basis for sustainable development of regions in the digital age. The foundation for such a transformation is the information and communication infrastructure and, first of all, the mobile Internet. The technological growth of mobile networks has provided a rapid increase in the number of users around the world, contributing to further digitalization. With the development of digital technologies, research in the field of human geography has received a new impetus. The impact of the Internet on all spheres of life has necessitated a rethinking of the existing geographical approaches to the study of physical space and the emergence of a new object of research — digital space. On the one hand, the latter is closely connected with traditional institutions and systems. On the other hand, it is characterized by its own patterns of construction and functioning. The problem of delimiting the boundaries of cyberspace makes it difficult to manage digital processes taking into account territorially determined needs and interests, while the current socio-economic unevenness of regional development results in the digital divide. Border regions, maneuvering within the dichotomy of ‘frontier — integration bridge’ models, can gain additional benefits from the development of digital infrastructure in the context of realizing their integration potential. This article assesses the geography of the mobile internet in Russia and its connection with the development of border regions. The authors use geo-information, statistical, and econometric analyses to assess the impact of mobile technologies on interregional information transfer, commodity-money flows, and migration. The study demonstrates the diversity in the availability of mobile internet access among residents in various categories of border and interior regions. Furthermore, the research establishes a link between the quantity of transmitted digital data, the import-export of goods and services, international migration, and two key metrics: the accessibility of 4G mobile internet and the number of mobile subscribers. The article pinpoints specific border regions within the Russian Federation, including Krasnodar Krai, Leningrad, Kaliningrad, Novosibirsk, Smolensk, Rostov, Chelyabinsk, Voronezh, Samara, and Kursk regions. These regions exhibit pronounced potential for executing integration functions through the advancement of digital technologies, particularly under favourable geopolitical conditions.

Reference

Introduction

In the 21st century, digitalization took centre stage, fundamentally altering many spheres of life. As of June 30, 2022,<1> almost 68 % of the world’s population used the internet, which makes this technology globally significant for subsequent digital growth. The internet has facilitated swift data and information exchange, fuelling scholarly debates about the reconfiguration of our familiar geographical landscape. This development has led to the emergence of a growing subfield within public geography, often termed cybergeography [1], digital geography [2], or virtual geography [3]. This subfield offers a robust theoretical and methodological framework for exploring the profound impact of ongoing digitalization on various social processes, encompassing socio-economic, political, and cultural dimensions. Cybergeography, in particular, focuses on unravelling the interactions between individuals, digital technologies, and geographical space. Moreover, it delves into the resulting changes in the role of geographical location within the digital realm, shedding light on emerging patterns in the territorial organization of the information society.

The increasing number of digital world studies is associated with the development of geoinformatics (geographical informatics, geomatics, geocomputer science, computer geography, or comgeography [4]). This research domain exists at the crossroads of geography and computer science and has gained widespread integration into educational curricula, particularly as a course centred on geoinformation systems and their practical utility as a research tool for analysing extensive geospatial datasets. This includes the incorporation of artificial intelligence and machine learning techniques [5], [6].

The widespread adoption of the internet and information and communication technologies (ICT) on a global scale has played a pivotal role in the development of open databases containing geocoded spatio-temporal data, which are now readily accessible for geographic analysis. This has formed the cornerstone for various fields of study focused on distinct facets of digitalization, such as the geography of information [7], information technology geography [8], the geography of the internet (including mobile technologies) [9], as well as studies related to communications and telecommunications (commonly referred to as telecommunications geography, telegeography, or geotelematics) [5]. Furthermore, this digital landscape has also given rise to research areas such as the geography of the information industry [10], among others. The evolution of digital technologies and their growing prevalence provide a compelling rationale for anticipating the proliferation of subjects for geographical inquiry. This, in turn, paves the way for their systematic organization within a unified interdisciplinary scientific framework. One such approach, as proposed by Blanuts [11], suggests the emergence of a coherent field like information and network geography.

This study advances geographical concepts regarding the distribution of digital infrastructure and the socio-economic dynamics of internet utilization. The primary emphasis is on addressing regional imbalances within the digital landscape of Russia, particularly in connection with the development of mobile network infrastructure. The objective of this research is to offer a comparative evaluation of mobile internet accessibility and technological adoption, considering the impact of the border factor. The distinctive nature of border regions, marked by their frontier status and often peripheral positioning in relation to economic hubs, plays a significant role in a heightened demand for accelerated digital infrastructure deployment within these areas.

The introduction of digital technologies may have a positive impact not only on intraregional socio-economic processes but also on improving connectivity for border areas with the main territory of the country. It can also enhance their role in international trade, including increasing the efficiency and safety of border and customs control services. A comprehensive utilization of the digital potential in border regions encompasses the development of both fibre-optic networks and wireless cellular and satellite technologies. This should enhance citizens’ internet access (including in border areas) and reduce the digital divide in both domestic and international contexts.

Theoretical basis of the study

The widespread adoption of portable communication devices like smartphones and mobile phones, both in developed and developing nations, combined with telecom operators’ efforts to extend mobile internet coverage to remote areas [12], has significantly improved mobile service accessibility. In many countries, these devices have now taken the lead as the primary means of accessing the internet, surpassing traditional wired connections. The ongoing technological advancements in mobile networks, such as bandwidth upgrades, increased base station density, optimized tariffs, and improved digital literacy, have collectively led to a surge in active internet users. This has, in turn, expanded the global digital sphere, establishing mobile internet as a cost-effective and accessible means of communication and data exchange.

Digital transformation has significantly reshaped our understanding of geography. It has introduced new criteria for gauging and reimagining space, closely linked to the accessibility of digital technologies and the density of information and communication infrastructure [13]. Nonetheless, this transformation has led to an unequal technological terrain [14], resulting in a shift from central to peripheral positions within the global cyberspace. Remarkably, the virtual realm is not isolated from the physical world; instead, it seamlessly integrates into daily life. Digitalization represents a remarkable phenomenon in which, on one hand, the digital environment diverges significantly from traditional institutions and systems, at times even conflicting with them. Yet, on the other hand, it actively supports and enhances their performance in the digital age [15].

Since institutional boundaries are inextricably linked with territorial and social ones [16], geography is still a significant factor in digital development. According to Kabanov [17], cyberspace increasingly affects real space, fuelling the scientific discourse around the state’s role in managing digital flows and delimiting state borders in the virtual world to establish digital sovereignty. Thus, the metaphor of the electronic, or digital frontier as a mobile boundary for cyberspace development seems appropriate. Its permeability depends on the density of ICT infrastructure, the spread of digital technologies and their effectiveness, and the development of network structures and routine practices [18].

Russian researchers are actively involved in geographical studies on the national digital space development in terms of spatial accessibility and diffusion of ICT, the information society and the state (for the results see, for instance, thematic publications [19], [20]). Smirnov, focusing on international differences in the accessibility of the internet, believes they result from the cross-influence of economic and geographical factors, including urbanization, proximity to developed internet markets, infrastructure accessibility, local cultural specificity and population density [21]. Trofimova [22], studying the digital divide between Russian regions, comes to similar conclusions, defining three main groups of its factors: socio-economic, socio-demographic and cultural.

Regarding digitalization in Russian regions, key economic factors include the gross regional product per capita, which exhibits a positive correlation with the level of telecommunication development [23]. Additionally, the average monthly cost of mobile communication and internet services plays a pivotal role. When these costs are high relative to wages, it notably reduces the accessibility of ICT. Similarly, a significant portion of household income allocated to food expenditure also diminishes accessibility to information and communication technologies (ICT) [24]. The average age and level of education remain socially significant factors of digital disparity across Russian regions as they determine everyday use of the internet and digital technologies. The study by Zemtsov et al. [25] substantiates the positive relationship between the share of the urban population with higher education and the share of online shoppers in the total regional population.

A high degree of geographical heterogeneity persists across the Russian internet space [25], [26]. The digital divide between urban and rural areas, towns and large cities is still significant [27], [28]. The article by Shestak [29] shows that the larger the city’s population, the more developed its internet services are. In line with global trends, we can observe a widening structural disparity in the development of mobile and fixed information and communication technologies (ICT) among Russian regions, and this disparity is still growing [30]. According to a 2014 online survey of internet users [31], in four out of eight federal districts (Southern, North Caucasian, Ural and Far Eastern), mobile internet is more widespread than broadband access. The presence of mobile networks in Russian regions is closely tied to economic hubs, such as areas with significant mineral development and popular tourist destinations. Additionally, the quality of existing transportation infrastructure plays a role in determining the accessibility of mobile networks in these regions [32].

Digital technologies play a special role in border, peripheral and remote areas enhancing their cognitive proximity [33]. A clear example is the case of Kyrgyzstan [34] where mobile internet and social networks have positively impacted the connectivity of residents of remote mountainous areas, contributing to the transformation in the use of transport infrastructure. Moreover, ICT development facilitates the establishment of communication channels between neighbouring (including border) territories. Mobile technologies contribute to the formation and dissemination of geopolitical images of countries and regions [35].

Chinese researchers [36] have demonstrated that geographical proximity remains a significant factor in capturing online attention. Typically, people tend to engage with content that is geographically tailored, either created in their region of residence or specifically for it. Additionally, internet users in neighbouring countries, sharing cultural and linguistic commonalities, tend to exhibit similar online behaviour [37].

An investigation based on Russian borderland data [38] reveals that users from these regions actively seek information regarding border regions and cities in neighbouring states more actively than the national average. Consequently, the challenge of culturally and geographically positioning border areas within the cross-border information space becomes significant, mainly due to the scarcity of content available in the national languages of neighbouring countries [39].

In light of these findings, this study conducts a comparative assessment of the technological capabilities of border regions in generating digital content and explores the prospects of such content generation within the context of the current mobile network density.

Research Methodology

The study covers 85 out of the 89 Russian regions. It includes Moscow and the Moscow region, St. Petersburg and the Leningrad region, as well as Sevastopol and the Republic of Crimea, considered jointly. Notably, the study excludes the territories of the Donetsk and Luhansk People’s Republics, as well as the Zaporizhzhia and Kherson regions due to a lack of available information. The geoinformation analysis of mobile internet coverage across the territory was conducted using aggregated data from Russia’s largest mobile network operators, including MegaFon, Beeline, Tele2, and MTS (for the Republic of Crimea and Sevastopol — Vinmobile and Volnamobile). These data were current as of April 8, 2023.

It is worth noting that the number of telecom operators varies across Russian regions. Specifically, two regions (the Republic of Crimea and Sevastopol) have two operators, while 15 regions (including the Amur and Astrakhan regions, Chukotka and Nenets Autonomous Districts, Trans-Baikal Territory, Republics of Yakutia, Bashkortostan, and Kalmykia, and regions within the North Caucasus Federal District) have three operators. In the remaining 68 regions, there are four operators providing services.

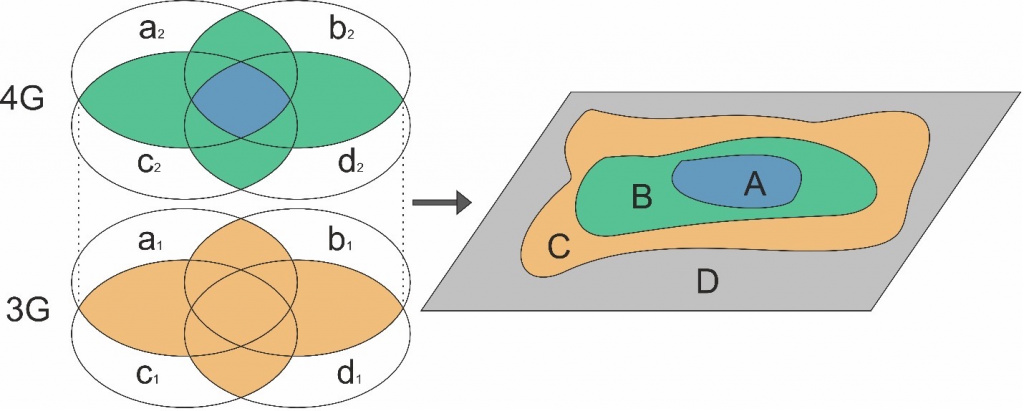

The method of calculating the integrated mobile internet coverage is based on a logical combination of raster layers of 3G and 4G mobile coverage from all telecom operators in the region according to the model developed by the authors (Fig. 1).

|

| 1 |

Model for calculating the integral mobile internet coverage |

Source: developed by the authors. |

The calculations involved a two-stage process. In the first stage, we identified the overlapping areas of 3G and 4G/LTE mobile coverage from various communication companies. In the diagram, separate areas of 3G coverage from different operators were designated as A1, B1, C1, D1, and for 4G coverage — A2, B2, C2, D2. This initial analysis resulted in the identification of three main logical combinations of layers:

A — zones where mobile 4G internet is simultaneously available from all operators in the region (as depicted in Figure 1 in blue).

B — zones where 4G internet is available from at least one of the operators in the region (shown in green).

C — zones where 3G internet is available from any of the operators in the region (indicated in orange).

In the second stage, we aggregated the selected layers using the built-in tools of the “QGis 3.28” software, through sequential superposition. The lower layer represents the C zone, which is subsequently overlaid by the A and B zones. Zone D represents territories with no 3G or 4G mobile internet coverage.

The result of geoinformation calculations is a set of quantitative values reflecting the spatial distribution of mobile internet in the Russian regions, including the communication quality and the diversity of operators. Four types of mobile coverage have been identified:

A — 4G coverage from all telecom operators;

B — 4G coverage from at least one telecom operator;

C — 3G coverage disregarding the number of telecom operators;

D — mobile internet is unstable or absent.

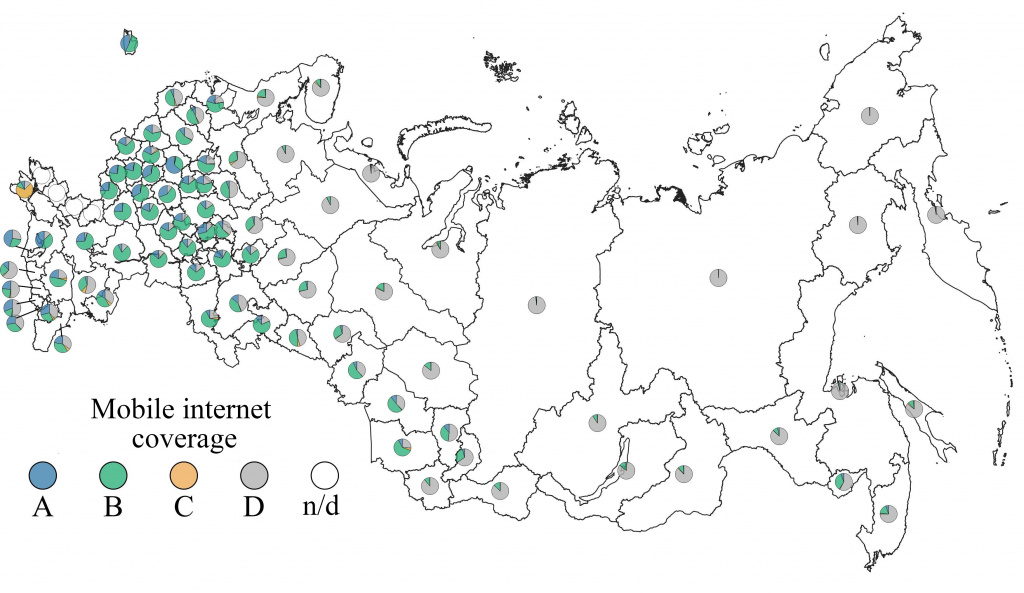

The study identifies their distribution in each Russian federal subject (Fig. 2) and provides quantitative data using median values along with the lowest and highest index values (Table 1).

|

| 2 |

| The structure of mobile internet coverage in Russian regions, 2023 |

| Место для текста об источнике |

Note: Moscow and the Moscow Region, St. Petersburg and the Leningrad Region, Sevastopol and the Republic of Crimea are considered jointly.

Data source — Table 2.

Table 1

Types of mobile internet coverage in Russian regions

Part of the region with the type of coverage, % | Coverage type | |||

A | B | C | D | |

Maximum | 63.5 | 81.0 | 69.8 | 99.3 |

Median | 8.6 | 37.6 | 0.5 | 36.7 |

Minimal | 0.01 | 0.5 | 0.03 | 0.5 |

Number of regions with better than median mobile coverage | 43 | 43 | 43 | 39 |

Region with maximum value | Moscow and the Moscow region | Volgograd region | Sevastopol and the Republic of Crimea | Chukotka Autonomous Okrug |

Region with minimum value | Chukotka Autonomous Okrug | Chukotka Autonomous Okrug | The Voronezh region | The Voronezh region |

Note: Moscow and the Moscow Region, St. Petersburg and the Leningrad Region, Sevastopol and the Republic of Crimea are considered jointly.

Data source — Table 2.

The study has employed statistical and econometric analysis methods to evaluate how the presence of digital mobile infrastructure and internet usage by residents influence the socio-economic development of Russian regions, while also considering their economic and geographical positioning (including the impact of the border factor). Table 2 presents several key quantitative indicators chosen for regression models, with the index values referring to the most recent year available. The analysis was conducted using StatTech v. 3.1.6 software provided by StatTech LLC.

Independent variables (factors) | ||

Index | Expected impact | Data source, year |

Number of mobile and internet operators in the region, units | + | Authors’ calculations based on the data provided by mobile operators: MegaFon,<2> Beeline,<3> Tele2,<4> MTS<5> (for the Republic of Crimea and Sevastopol: Vin Mobile<6> and Wave Mobile<7>), April 2023. |

Part of the region with unstable or no mobile internet, % | – | |

Part of the region with 3G coverage (regardless of the number of telecom operators providing it), % | + | |

Part of the region with 4G coverage from at least one telecom operator, % | + | |

Part of the region with 4G coverage from all telecom operators, % | + | |

Number of subscriber devices for mobile radiotelephone (cellular) communication per 1,000 population, units | + | EMISS,<8> 2021. |

Share of subscription fee for cellular communication and internet access in the average per capita income, % | – | Calculated according to Rosstat<9> and<10> EMISS data<11> as of the end of 2021 |

Index | Expected impact | Data source, year |

The volume of postal services per capita, rub | +/– | Rosstat,<12> 2021 |

Dependent variables characterizing the development | ||

Index | Characteristics of the freedom of movement | Data source, year |

Information transmitted from/to subscribers of the mobile network of the reporting operator when accessing the internet, petabytes | Information flow | Rosstat,<13> as of the end of 2021 |

Share of the region in national imports, % | Goods and capital flow | Rosstat,<14> 2021 |

Share of the region in national exports, % | ||

Share of the region in the total number of international migrants aged 15 years and older residing in the country, % | Migration flow | Rosstat, data from a sample household survey on the use of migrant labour,<15> 2019. |

The selection of dependent variables was based on the integration functions of regions that act as crucial connectors between national and global economic systems [40]. Proximity to the state border, including maritime borders, facilitates the realization of international trade potential [41]. A study conducted by Savenkova et al. [42] provides substantial evidence of a direct and close relationship between foreign trade turnover and the gross regional product of Russian border regions. Furthermore, Russia’s border regions actively engage in continuous international migration, which serves as both a source of population growth and a factor contributing to population outflows [43].

The movement of goods and people generates significant volumes of digital information. For instance, the research reveals a robust positive correlation between the balance of web traffic and the trade in services [44]. Consequently, regions that are actively fulfilling their integration potential in traditional spheres can be anticipated to exhibit a similar trend in the flow of digital data.

In conducting this study, we employed two distinct approaches to classify Russian regions based on their economic and geographical characteristics.

The first approach draws from Fedorov’s work [45] on the typology of Russian Federation subjects, taking into account the time at which they assumed their border functions. This approach categorizes regions into the following groups:

1. ‘Old’ border regions (comprising a total of 26) that became border regions before 1991.

2. ‘New’ border regions (22 in total) that became borderline regions after 1991. This group also includes the Voronezh and Rostov regions, which transitioned to the group of interior regions in 2022.

3. ‘Newest’ border regions (six in total) that were not included in the analysis. This group encompasses the Republic of Crimea and Sevastopol (since 2014), the Donetsk and Lugansk People’s Republics, Zaporozhye, and Kherson regions (since 2022).

4. Interior regions (35 in total).

The second approach is based on Kolosov et al.’s research [46], focusing on evaluating the barrier function of the state border. It categorizes regions into five groups:

1. Regions bordering unfriendly European countries, such as Ukraine, Poland, Lithuania, Latvia, Estonia, and Finland (comprising 13 Russian regions with closely interconnected borders; the Murmansk region, which shares a border with Norway, is included in the Arctic group).

2. Regions bordering friendly and neutral post-Soviet countries, including Belarus, Kazakhstan, Georgia, Azerbaijan, South Ossetia, and Abkhazia (encompassing 22 Russian regions with borders of varying ‘tightness’).

3. Regions bordering friendly Asian countries, such as China, Mongolia, and DPRK (comprising seven regions with tight borders).

4. Arctic regions and those with maritime borders with the United States and Japan, with a total of 13 regions, nine of which operate under the RF Arctic zone regime.

5. Other 34 interior regions.

Research Results

Regional disparity in mobile internet coverage

in the Russian Federation

The diversity of Russian regions by their socio-economic development and natural and geographical conditions makes the provision of equal access to mobile internet technologies difficult. Table 3 presents data on mobile coverage by type of region.

Group of regions | Type of mobile internet coverage | ||||

A | B | C | D | ||

Share of the total territory, % | |||||

The first classification approach: by the period of integration potential accumulation | |||||

Old border regions | having a land and a maritime border | 2.8 | 10 | 0.9 | 86.3 |

having a land border | 1.4 | 12.4 | 1.1 | 85.1 | |

having a maritime border | 0.3 | 1.6 | 0.4 | 97.7 | |

having a maritime border with access to the economic zone of the Russian Federation | 0.2 | 2.1 | 0.4 | 97.3 | |

the land border established in 1991 regions having a maritime border with access to the economic zone of the Russian Federation | 30.5 | 40.1 | 3.4 | 25.9 | |

Total | 1.1 | 4.9 | 0.6 | 93.4 | |

New border regions | having a land border | 10 | 57.6 | 1.8 | 30.7 |

lost their border status after 2022 | 25.2 | 71.4 | 0.5 | 2.9 | |

Total | 11.4 | 58.9 | 1.6 | 28 | |

Newest border regions | having a land and maritime border | — | — | — | — |

having a land border | — | — | — | — | |

having a maritime border | 7.5 | 10.5 | 69.8 | 12.2 | |

Total | 7.5 | 10.5 | 69.8 | 12.2 | |

Interior | Total | 6.2 | 27.4 | 0.9 | 65.5 |

The second classification approach: by the ‘tightness’ of the border | |||||

First group | bordering unfriendly European countries | 23.1 | 62.6 | 4.5 | 9.8 |

Second group | bordering friendly and neutral post-Soviet countries | 10.3 | 52.4 | 1.8 | 35.5 |

Third group | bordering friendly Asian countries | 1.3 | 8.7 | 0.7 | 89.3 |

Fourth group | Arctic regions and regions with maritime borders with the US and Japan | 0.2 | 3.8 | 0.6 | 95.4 |

Fifth group | Other regions | 6.4 | 31.3 | 0.9 | 61.4 |

Moscow and the Moscow region | 63.5 | 33.4 | 1.0 | 2.1 | |

Data source — Table 2.

The evaluation of mobile internet coverage in Russian regions in 2023 underscores the persistent spatial disparities in digital infrastructure development. The frontrunner in mobile internet accessibility is a highly urbanized and economically advanced metropolitan conglomeration that encompasses Moscow and the Moscow region. This area enjoys comprehensive 4G coverage provided by all the telecom operators analysed. The average speed of 4G is three times higher than that of 3G, with a more substantial difference in maximum speeds, enabling the transfer of more digital data per unit of time.

In contrast, the Old border regions exhibit low aggregate indices of high-speed mobile internet coverage. Several factors contribute to this situation, including dispersed settlement patterns, except in economically well-developed and highly urbanized regions like the Kaliningrad region, the Leningrad region, St. Petersburg, and the Krasnodar territory. Additionally, the northern and mountainous areas of some regions pose technical challenges to ICT development. Furthermore, within the Old border group, there are vast regions such as the Krasnoyarsk Territory and the Republic of Sakha, which, despite having a maritime border with access to the Russian Federation’s economic zone, are essentially interior regions. Establishing digital infrastructure in these areas entails higher costs and often lacks economic viability. Typically, only the most densely populated and economically developed areas have access to mobile and internet connections.

The New border regions show high infrastructural availability of mobile internet: the share of the territory where it is unstable or absent is less than 30 %. The leaders are the Voronezh, Kursk, Belgorod and Rostov regions which have almost full mobile internet coverage, including 4G. At the same time, with the inclusion of the new regions into the Russian Federation in 2022, the Voronezh and Rostov regions will gradually (after the resolution of the Ukrainian conflict) lose their integration functions and will become interior regions.

Our analysis encompasses the Republic of Crimea and Sevastopol, both classified as regions within the New border regions group. In these regions, the deployment of mobile internet infrastructure is undergoing a transformational phase, being largely influenced by institutional factors. Currently, mobile and internet services are provided by two operators in Crimea. Notably, Sevastopol boasts the best coverage compared to the rest of the peninsula, with 4G available in 50 % of its territory, while in the Republic of Crimea, 4G coverage is limited to just 17 %.

When employing the second approach for the classification, Russian regions bordering unfriendly European countries emerge as leaders in mobile coverage. These regions are characterized by their high levels of industrialization and urbanization. The significant capacity of their domestic markets and favourable natural conditions have enabled the deployment of ICT infrastructure across most of their territories, ensuring widespread access to high-speed internet.

Regions bordering friendly and neutral post-Soviet countries follow closely in mobile communication and internet infrastructure development. This group includes the republics of the Caucasus, whose territories feature mountainous terrain that poses challenges to mobile coverage. Consequently, there is a higher proportion of territory without mobile coverage, with an average of 35.5 % within this group.

The regions bordering friendly Asian countries face the most significant challenges in terms of internet access. Almost 90 % of their territory lacks mobile internet coverage. An even more critical situation is observed in the Arctic and eastern coastal regions, where 95 % of the territory remains without coverage.

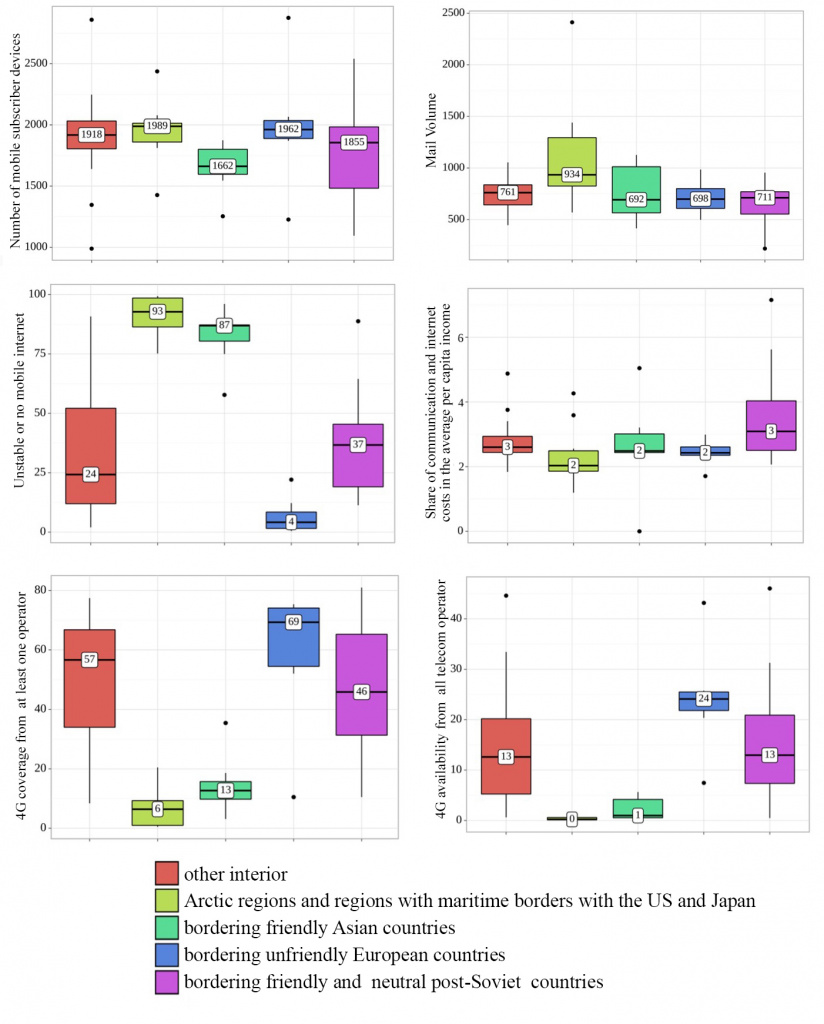

A preliminary statistical analysis was performed for each index using a block diagram with emission limiters to give an idea of the asymmetry of the data (Fig. 3). The calculations depended on the ‘region type’ categorical variable using the Kruskal-Wall criterion allowing to determine the significance of the differences between the data sets for the median, minimum and maximum index values.

|

| 3 |

| Dependence of ICT development indices on the type of a region |

Developed by the authors (data sources — Table 2) using StatTech v. 3.1.6 software. |

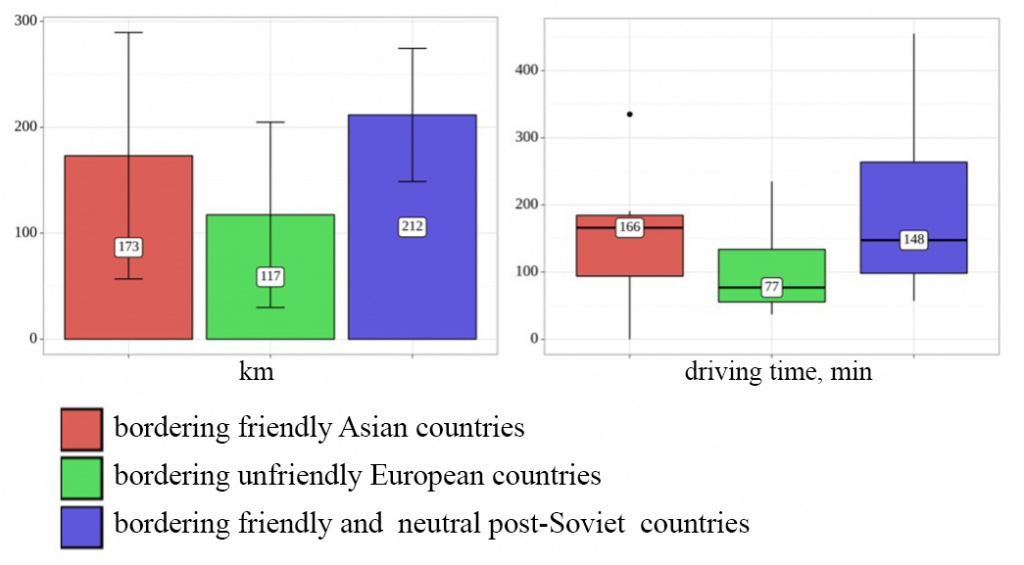

The analysis results show that the differences between the groups of regions are statistically significant in most indices used in the study: the number of mobile devices, mail volume, the percentage of territory with unstable or no mobile internet access, the availability of 4G coverage provided by at least one telecom operator or by all telecom operators, as well as the proportion of communication and internet costs relative to the average per capita income. Consequently, these data are valuable for further comparative analysis. Additionally, the analysis provides statistical support for variances in the proximity of administrative centres to the nearest vehicle checkpoint for Russian regions with a land border, as depicted in Figure 4.

|

| 4 |

| Distance from the administrative centres of the Russian border regions to a border crossing point, km and min by car (by region type) |

Developed by the authors (data sources — Table 2) using StatTech v. 3.1.6 software. |

On average, the capital cities of the Russian regions neighbouring unfriendly European countries are the closest to the border. Previously, in a more favourable geopolitical situation, this factor was a catalyst for integration. However, at the moment, it is more of an inhibitor. The administrative centres of those Russian regions that border friendly and neutral post-Soviet countries are the most remote from the customs checkpoints. It seems logical that digitalization can serve as a compensatory tool they can use to promote cooperation.

The impact of digitalization on the integration functions of the Russian regions

Since the distribution of quantitative indices (Table 2) for the Russian regions differs from the normal one, the direction and tightness of the paired correlation between them were estimated using the Spearman Rank correlation coefficient. The analysis results identify four pairs of indices with a very tight correlation on the Chaddock’s scale (Table 4). All identified relationships are statistically significant at p < 0.05.

Dependent variable | Factor | Spearman’s rank |

Share of the region in national exports, % | number of mobile subscriber devices | 0.602 |

share of communication and internet costs in the average per capita income | – 0.589 | |

Share of the region in national imports, % | number of mobile subscriber devices | 0.635 |

share of communication and internet costs in the average per capita income | – 0.565 | |

Dependent variable | Factor | Spearman’s rank |

Share of the region in the total number of international migrants aged 15 years and older usually residing in the country, % | number of mobile subscriber devices | 0.426 |

Note. For this variable, there is the factor with the highest revealed value of the Spearman rank correlation coefficient (moderate) indicated. To avoid distortion, the calculations do not include highly urbanized Moscow and St. Petersburg agglomerations.

Developed by the authors (data sources — Table 2) using StatTech v. 3.1.6 software.

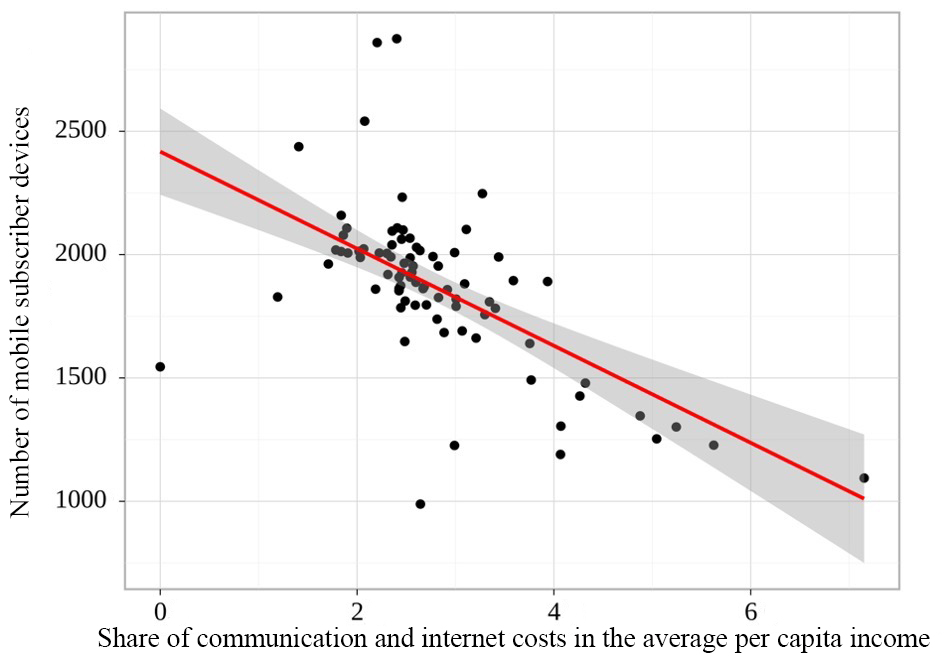

Significant correlations were found between the following indicators: ‘The share of communication and internet costs in the average per capita income’ and ‘The number of mobile subscriber devices’ (– 0.620, see Fig. 5); and ‘The number of mobile operators and internet providers’ and ‘The number of mobile subscriber devices’ (0.551). Therefore, the primary factor influencing the dependent variables that characterize the integration potential of Russian regions is the capacity of the subscriber network. The development of competition and the increase in the number of companies providing mobile communication and internet services have a positive impact on the number of subscribers while rising tariffs have a negative effect.

|

| 5 |

| Inverse relationship between the number of mobile subscriber devices and the share of communication and internet costs in the average per capita income of the Russian regions according to 2021 data |

Developed by the authors (data sources — Table 2) using StatTech v. 3.1.6 software. |

A further correlation analysis of factors and variables was carried out for several groups of Russian regions selected by their economic and geographical position (according to the approach proposed in [46]). The analysis considers only the indicators with significant statistical differences (p < 0.05).

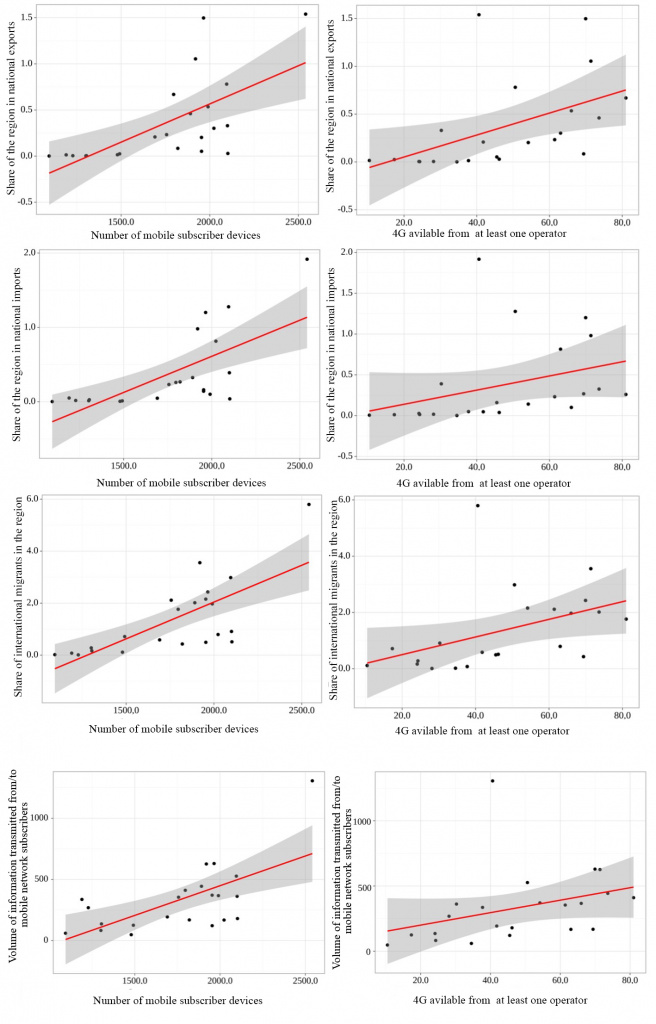

The regions bordering friendly and neutral post-Soviet countries show the strongest dependencies between the four variables and the digitalization factors (Fig. 6). The diversity of mobile operators and internet providers, the capacity of the domestic market of communication subscribers and the mail volume have a great positive impact (4G accessibility having a significant impact) on the foreign trade turnover (in exports and imports) of these regions. The results show a strong correlation between the share of international migrants in the region and the number of mobile subscriber devices (0.708). High-speed internet accessibility and the concentration of mobile subscriber devices are significant factors for the volume of information transmitted from/to mobile network subscribers.

The regions from the other groups show weaker correlations. For instance, in the regions bordering unfriendly European countries, 3G mobile internet was a significant positive factor for the share of international migrants (0.786), while 4G mobile internet coverage from all operators was a significant positive factor for the volume of imports (0.813). An increase in the share of communication and internet costs in per capita income has a significant negative impact (– 0.786) on imports to the regions bordering friendly Asian countries. In the Arctic regions, the lack of mobile internet (– 0.610) is a negative factor for the increase in the share of imports, while the deployment of a 4G network is positive (the correlation for all operators is 0.566). The major negative factor for foreign trade turnover in the interior regions (for imports — – 0.677; for exports — – 0.526) is communication and internet charges compared to the average per capita income. At the same time, the increase in mobile subscriber devices in these regions is positively related to an increase in the share of imports (0.634).

In terms of foreign trade turnover (primarily exports), digitalization indicators have the greatest impact on the second group (regions bordering friendly and neutral post-Soviet countries). It is reasonable to conclude that in regions with a low or medium ‘tightness’ of the state border, the development of digital infrastructure has a positive impact on enhancing the integration potential of border regions, and facilitating the flow of goods, money, and people.

|

| 6 |

Graphs of regression functions characterizing the dependencies between the development indicators of the Russian regions bordering friendly and neutral post-Soviet countries |

Developed by the authors (data sources — Table 2) using StatTech v. 3.1.6 software. |

Modelling the development of different types of Russian regions in the context of mobile digitalization

To assess the patterns of the border and interior regions’ socio-economic development associated with a wider spread of mobile technologies using the linear regression method for each quantitative variable in the “StatTech v.3.1.6” software, we formed predictive models characterizing its dependence on the factors specified in Table 2. The final models included only the factors with statistically significant differences (p < 0.05) (Table 5).

Group | Linear regression equation | Correlation coefficient (rxy) / level according | The percentage |

The amount of information transmitted of the mobile network when accessing the Internet (Ydata) | |||

Second group | Ydata = – 824.546 + 0.546X subscriber devices + 12.808X4G_all | 0.814 / strong | 66.2 |

Fourth group | Ydata = 391.582 – 0.192Xpost | 0.586 / significant | 34.3 |

Fifth group | Ydata=676.300 – 143.537Xcosts | 0.422 / moderate | 17.8 |

Share of the region in national imports (Yimport) | |||

First group | Yimport = – 5.570 + 0.002X subscriber devices + 0.123X4G_all + 0.039X3G | 0.995 / quite strong | 98.9 |

Second group | Yimport= – 1.810 + 0.001X subscriber devices + 0,020X4G_all | 0.802 / strong | 64.4 |

Fifth group | Yimport = 1.981 – 0.558Xcosts | 0.482 / moderate | 23.2 |

Share of the region in national exports (Yexport) | |||

First group | Yexport = 3.722 + 0.149X4G_all + 0.052X3G – 0.010Xpost | 0.972 / quite strong | 94.5 |

Second group | Yexport = – 0.470 + 0.001X subscriber devices – 0.009Xno internet | 0.729 / strong | 53.1 |

Fifth group | Yexport = 2.302 – 0.601Xcosts | 0.437 / moderate | 19.1 |

Group | Linear regression equation | Correlation coefficient (rxy) / level according | The percentage |

Share of the region in the total number | |||

Second group | Ymigration= –3.620 + 0.003Xsubscriber devices | 0.725 / strong | 52.5 |

Fifth group | Ymigration=1.971 – 0.439Xcosts | 0.380 / moderate | 14.5 |

Note: the models are statistically significant (p < 0.05).

X4G_all — the territory of the region with 4G coverage from all telecom operators, %; X3G — the territory of the region with 3G coverage, %; Xno internet — the territory of the region with unstable or no mobile internet, %; X subscriber devices — the number of subscriber devices of mobile radiotelephone (cellular) communication per 1,000 people, units.; Xpost — mail volume per capita, rub.; Xcosts is the share of communication and internet costs in the average per capita income, %.

To avoid distortion, the calculations do not include highly urbanized Moscow and St. Petersburg agglomerations.

Developed by the authors (data sources — Table 2) using StatTech v. 3.1.6 software.

Based on the presented models, it becomes evident that two of the examined indicators wield significant influence over the integration potential of both border and interior regions. These key factors include the extent of 4G mobile internet coverage provided by all telecom operators and the number of mobile subscriber devices per 1,000 population. The first factor encompasses both infrastructural and market dimensions. Firstly, it is tied to the presence of multiple telecom companies within the market, fostering healthy competition in the realm of mobile internet services and offering users a wider array of options. Secondly, the availability of 4G (and in the future, 5G) internet connectivity facilitates more extensive utilization of digital technologies by individuals and businesses, resulting in a substantial increase in the volume of digital data and information flows, thus propelling economic and social activities forward. The surge in the number of mobile subscriber devices is not solely attributable to new users among the region’s residents but also correlates with the diversification of their technical devices that rely on mobile internet connectivity. Consequently, this implies the normalization of digital practices within the population and an overall boost in digital literacy levels.

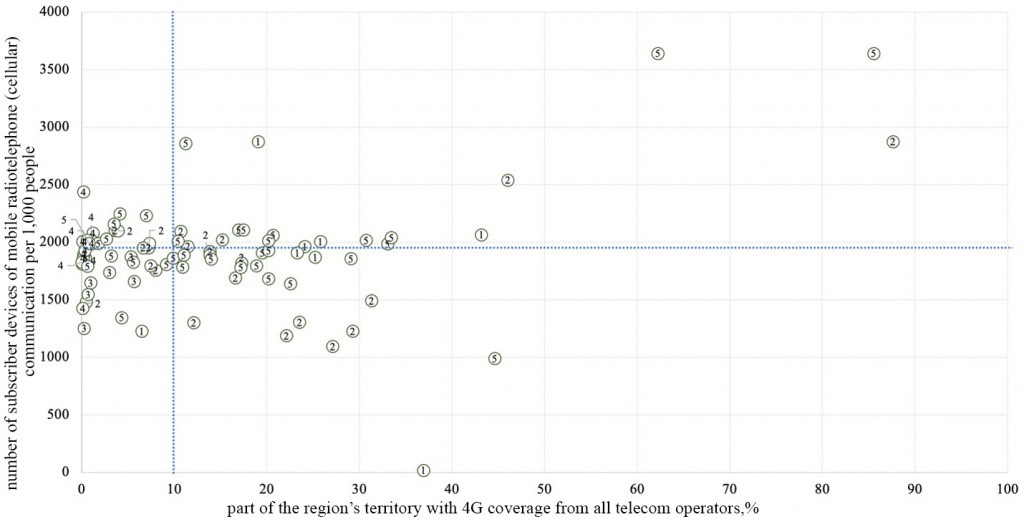

Only 12 interior regions (Moscow, the Moscow, Nizhny Novgorod, Kaluga, Yaroslavl, Orel, Tula, Ryazan, Lipetsk, Ivanovo, Vladimir regions, the Republic of Tatarstan) and 11 border regions (St. Petersburg, the Leningrad, Kaliningrad, Novosibirsk, Smolensk, Rostov, Chelyabinsk, Voronezh, Samara, Kursk regions; Krasnodar Krai) have both digitalization indicators higher than the national median (Fig. 7, 8). This can mean that their information, goods and capital, and migration flows are more likely to increase with the development of mobile technologies.

|

| 7 |

Distribution of Russian regions by the most important factors of digitalization |

Developed by the authors (data sources — Table 2). |

Note. Groups of regions: 1 — bordering unfriendly European countries; 2 — bordering friendly and neutral post-Soviet countries; 3 — bordering friendly Asian countries; 4 — Arctic regions and regions having maritime borders with the United States and Japan; 5 — other regions.

Median values for Russian regions: 10.7 % — the part of the region’s territory with 4G coverage from all telecom operators; 1907.9 units — the number of subscriber devices of mobile radiotelephone (cellular) communication per 1,000 population.

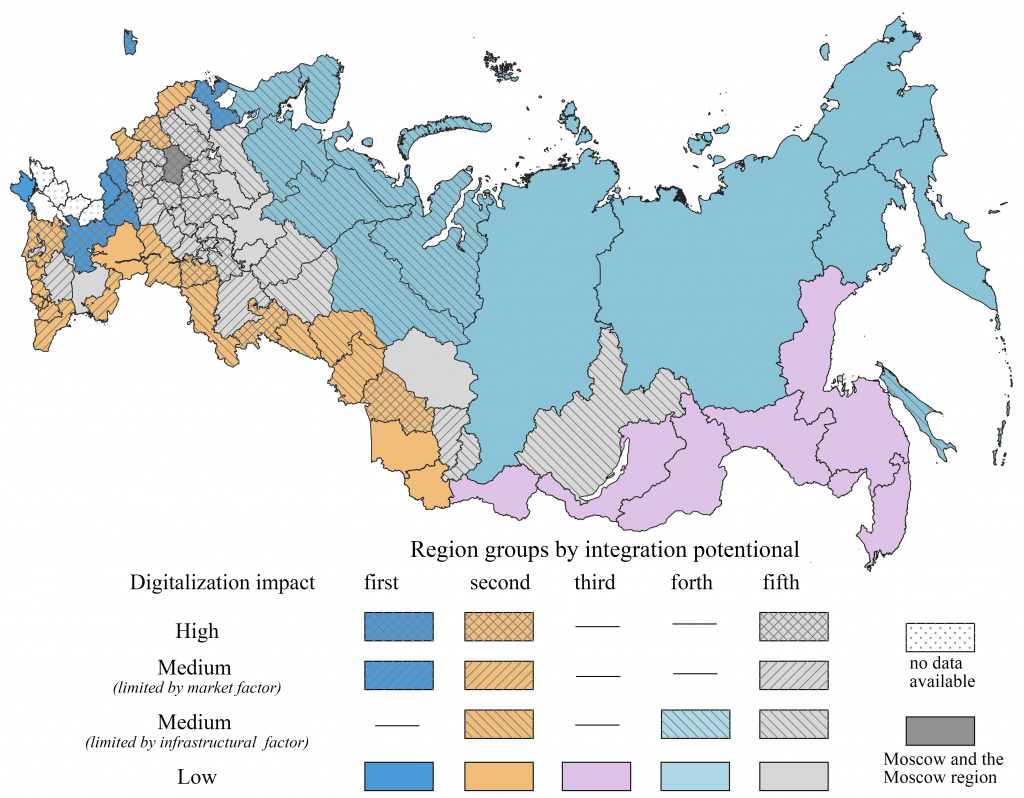

|

| 8 |

Types of regions of the Russian Federation in terms of their potential for activating the integration function as a result of digitalization |

Developed by the authors (data sources — Table 2). |

Note: Groups of regions: 1 — bordering unfriendly European countries; 2 — bordering friendly and neutral post-Soviet countries; 3 — bordering friendly Asian countries; 4 — Arctic regions and regions with maritime borders with the United States and Japan; 5 — other regions.

Main results

A significant shift in the geopolitical landscape has highlighted the need for Russian border regions to adapt to new economic circumstances. This adaptation includes the transformation of foreign trade and the restructuring of socio-economic ties with neighbouring countries [47]. This research aligns with the emerging field of cybergeography and continues the tradition of studying the cross-border dynamics of territorial development.

A comparative evaluation of mobile internet accessibility in the Russian border and interior regions underscores the persistent disparities within the national digital space, particularly in the dimensions of ‘centre—periphery’ and ‘north—south’. Notably, the Krasnodar Territory and the Kaliningrad region stand out as leaders in high-speed mobile internet availability in the border areas, although they still trail behind the Moscow agglomeration.

The regional discrepancies in mobile internet infrastructure development across Russia are primarily attributed to socio-economic, demographic, and environmental factors. Urbanised regions with high population density and economic prosperity tend to have better mobile internet coverage. Consequently, a digital divide exists between various types of Russian border regions, including the ‘Old’, ‘New’, and the ‘Newest’ border regions, both in terms of access to mobile services and mobile device usage.

Some Old border regions (e. g., the Leningrad region and St. Petersburg, Kaliningrad region, Krasnodar Territory) and New border regions (e. g., the Novosibirsk, Smolensk, Rostov, Chelyabinsk, Voronezh, Samara, Kursk regions) exhibit the most favourable technological conditions for facilitating the flow of data, goods, and people in the digital age.

In the digital era, mobile technologies have become an increasingly vital factor for border regions to unlock their integration potential. This study reveals the positive influence of mobile internet accessibility on international migration and foreign trade activities, including export growth, particularly in border regions with low to medium border ‘tightness’. The advancement of mobile digital technologies further fosters the growth of cross-border trade and the e-commerce sector. Wider access to high-speed mobile internet serves as a technological foundation for amplifying the generation of digital information, including geographically tailored content, which is essential for positioning border regions in the information sphere. Therefore, the pivotal factors driving the socio-economic development and integration potential of Russian regions include the establishment and growth of mobile communication and internet infrastructure, expanded accessibility of mobile technologies to residents, and the encouragement of digital literacy and receptiveness. A favourable geopolitical situation also plays a significant role.

The study was supported by the Russian Science Foundation, project № 21-77-00082 «Digital transformation of cross-border cooperation of Russian regions as a factor of national security».