Territorial structure of inbound and domestic tourism in the Baltic States

- DOI

- 10.5922/2079-8555-2023-1-7

- Pages

- 120-138

Abstract

This paper examines the transformation of the territorial structure of tourism in Estonia, Latvia and Lithuania. The spatial and temporal organisation of tourism in these countries has undergone significant changes since they became independent and joined the EU. These changes have affected the geography of tourist flows and destinations of interest. This study aims to define the geographical and economic peculiarities of the development of tourism in the Baltic States and to identify the central, peripheral and semi-peripheral regions. Elements of the centre-periphery structure were identified through cluster analysis covering the period 2009—2019. Eleven indicators were used to determine the level of socio-economic development, the state of inbound and domestic tourism and the degree of transport infrastructure development. The results of the study suggest that there have been progressive changes in the territorial structure of tourism in the Baltic States. The main centres of attraction are the capitals and their adjacent territories. Horizontal contacts with more developed regions of the EU states and vertical interaction with other regions of Estonia, Latvia and Lithuania have a significant impact on the development of tourism activities. Central regions are dominant in terms of attracting tourist flows. This is characteristic of a highly polarized tourism structure. However, many semi-peripheral and peripheral regions have lately improved their position, being integrated into national and cross-border tourism routes and increasing outreach in the tourism market.

Reference

Introduction

The Baltic States — Latvia, Lithuania and Estonia — entered the global tourist market quite recently, after gaining independence in 1991. Today, tourism is a major factor in their socio-economic development. According to the World Travel and Tourism Council,<1> the industry accounted for 12.1 % of Estonia’s GDP in 2019, compared to 10.3 % worldwide. In Latvia and Lithuania, this proportion is also significant, albeit below the global average: 7.7 % and 6.0 % respectively. Moreover, tourism, one of the most labour-intensive sectors of the economy, creates new jobs. Estonia’s tourism industry is the largest contributor to national employment (11.7 %). In Latvia and Lithuania, the share of those employed in tourism was 8.3 % and 4.8 % respectively.

A comprehensive indicator for comparing tourism development at a national level is the Travel and Tourism Competitiveness Report. In the 2019 document,<2> the Baltic States ranked in the top half of the 136-strong list, which points to the attractiveness of doing business in their tourism markets. Estonia ranked 46th, Latvia 53rd and Lithuania 59th. Amongst the key competitive advantages, experts name a well-developed healthcare system, a low crime rate, a relatively high level of the locals’ ICT skills and affordable prices of services. Constraints to competitiveness include insufficient openness towards international travel and the paucity of natural and cultural resources.

In 2019, the total number of arrivals in Estonia was 3.3 million; in Latvia, 1.9 million; in Lithuania, 2.9 million.<3> The length of stay in the Baltic states varies from year to year, due to both global events and the low-base effect. In 2019, 4.2 million tourist overnight stays were registered in Estonia; 7.8 million, in Latvia; 3.7 million, in Lithuania. In the 21st century, the number of arrivals and the length of stay in the three countries have been primarily affected by economic crises and geopolitical changes. Traditionally, the main inbound tourism flows (90 %) in Latvia, Lithuania and Estonia come from the European region. The main countries of visitor origin can be divided into three groups: neighbouring states, historically related countries and leaders in the European market [1].

Latvia, Lithuania and Estonia concentrated at first on promoting their metropolitan regions, which attracted the most interest from tourists. But, over time, the visibility of other regions of the Baltic States has increased, affecting the geography of inbound and domestic tourism in these countries. These regions, neighbouring the most attractive destinations, embarked on becoming part of tourist routes and drawing in more visitors. For example, the tourism exchange between Riga and Pierīga developed over the years by virtue of a serviceable transport network and a shared tourism product. The share of this exchange in the total tourist travel increased from 15 % in 2009 to 17 % in 2019, whilst that of international arrivals reached 25 % in 2019.<4>

This study seeks to identify and describes the territorial structure of the tourism space and how it has changed in the 21st century due to the growing interaction between the Baltic States, their neighbours and other European countries. The spatial structure development is examined from the standpoint of the centre-periphery model of tourism space. The identification of core regions, less developed peripheral territories and intermediate semi-peripheral areas provides a rationale for spatial development strategies for tourism and makes it possible to increase the efficiency of tourism destination management by distinguishing between driver regions and territories in need of support.

State of research

A surge of scientific interest in tourism development in the Baltic States as a cohesive region coincided with the independence of these countries. Agita Šļara and Iveta Druvaskalne have examined the role tourism played when the three states were joining the common European space [2]. Russian geographers focus on international cooperation in tourism and its specific spatial forms, such as transboundary tourist and recreational regions (TTRR). Irina Dragileva, Elena Kropinova, Andrei Manakov and other authors investigate in their works transboundary region building in the Baltic area in terms of tourism and recreation. They have described the essence, features, factors and patterns of TTRR building at macro-, meso- and micro-levels identified the most effective tools of transboundary cooperation in tourism and proposed a typology of Baltic TTRRs [3], [4], [5], [6], [7], [8]. Svetlana Kondratyeva (Stepanova) has evaluated the potential for cross-border interactions between neighbouring regions in the north of the Baltic macroregion [9], [10]. Despite the growing number of works exploring various aspects of tourism-focused cross-border cooperation and transboundary interactions in the Baltic region, tourism and recreation are a relatively new object for cross-border research. In Russian recreational geography, only the first steps have been made towards a theory and methodology to study the tourism potential of state borders and transboundary tourism region building.

Another set of works looks at special types of tourism in the Baltic region and their territorial organisation. It is worth noting the contributions by Melanie Smith on health tourism in the Baltic area [11]; Virgil Nicula and Simona Spânu, rural and gastronomic tourism [12], Aleksei Anokhin, Elena Kropinova and Eduardas Spiriajevas, geotourism [13]. Many works investigate the general state of the tourism industry in the Baltic States [14], [15], [16], [17], ways to improve its competitiveness [18], [19] and COVID-19 relief measures [20], [21], [22].

Of special interest are the works by Baltic authors employing a comprehensive approach to explore the tourism systems of each of the three states. A significant contribution to the study of the Estonian tourism system has been made by Jeff Jarvis [23], Heli Müristaja [24], Heli Tooman [25]; Latvian tourism, by Ilgvars Abols, Andris Klepers, Maija Rozite [26]; Lithuanian, by Eduardas Spiriajevas [27], Algirdas Stanaitis, Saulius Stanaitis [28].

The centre-periphery model, showing how central and peripheral areas interact as they develop, is the key to a theoretical justification for transformations in the territorial structure of inbound and domestic tourism in the Baltic States. Developed by John Friedmann in the framework of the regional approach, the model has been extended to tourism. It may facilitate assessing tourism space polarisation at different hierarchical levels. The three-tiered spatial structure of tourism has been considered in terms of tourism by Anna Aleksandrova, Viliyan Krastev, Ivan Pirozhnik and others [29], [30], [31].

Recently, the academic interest in tourism and recreation in the Baltic region and its constituent countries has increased. The literature is growing, and the topic is being gradually recognised as a major research problem. Yet, the territorial structure of tourism in the Baltics is still not fully understood, remaining a peripheral interest of Russian and international recreational geographers.

Materials and methods

To develop a classification of regions of the Baltic States according to advances in tourism, we used a statistical method consisting in automatic data processing and collating, namely cluster analysis. The term was coined by the American psychologist Robert Tryon in 1939 [32]. A definite advantage of cluster analysis is its applicability to processing a large data set with several variables and classifying objects based on this information. Two necessary conditions for classification are simultaneously met in this case: each object falls into one cluster only; the clusters cover all the objects. A cluster method classification was performed using the IBM SPSS Statistics statistical analysis software.

Amongst the disadvantages of the cluster approach is the subjectivity of the indicator selection and, consequently, groups sharing common features. Thus, it is important to optimise the selected indicators as, on the one hand, a strong direct correlation between the parameters or their small number may cause problems with distinguishing meaningful groups, and, on the other, a substantial quantity of parameters may result in a profusion of small groups comprising very few objects and unable to cover the entire system [33].

Creating a centre-periphery model of tourism and recreation space requires distinguishing clusters at the lowest hierarchical level for which there is statistical information. This study relies on the Nomenclature of Territorial Units for Statistics (NUTS) developed by Eurostat to collate and analyse statistical data across territorial levels. Using this system ensures the representativeness of a concurrent study of the three states. Since the Baltics are quite small in terms of area, this study will focus on NUTS 3 level, which represents lesser territories. The clustering will be carried out at that level as well.<5>

The study encompasses a decade-long period, spanning from 2009 to 2019. The selection was determined by the existing dynamic data series from the Estonian, Latvian and Lithuanian statistical authorities. Information on the data of interest was taken from the official websites of the statistical offices of the Baltic States: Statistics Estonia,<6> Central Statistical Bureau of Latvia<7> and Statistics Lithuania.<8>

Taking into account the above and drawing on earlier findings [29], [34], we used 11 relative indicators to develop the classification. These indicators can be grouped as follows.

— The indicator of the overall socioeconomic development of a territory: GDP per capita (in current euros). According to the estimates of the World Tourism Organisation (UNWTO), the dynamics of tourist flows depend directly on GDP growth/decline. An average annual economic growth of about 4 % or higher translates into tourism development at an even faster rate. The opposite situation arises when the rate of economic growth is below 2 %. In 1975—2000, GDP increased at an annual average rate of 2 %; GDP grew by 3.5 % on average annually and international tourism by 4.7 %, i. e., 1.3 times faster.<9>

— Indicators of the role a region plays in inbound tourism: the inbound arrival rate (‰), i. e. the annual number of international tourist arrivals per 1,000 inhabitants; a region’s share in total annual inbound arrivals (%), a measure of regional contribution to tourist reception; the average length of stay of international tourists, i. e. the ratio between overnight stays at regional hotels and similar premises to the total number of international tourist arrivals.

— Indicators of a region’s role in domestic tourism: domestic tourist arrival rate (‰); a region’s share in total annual domestic tourist arrivals (%); the average length of resident tourists’ stay in a region.

— Indicators of transport infrastructure development: availability of air transport facilities in a region, planes being the principal means of transportation today (2 points are awarded for an international airport; 1 for a local airport; 0 for no airport; if there are several airports region, the points are summed).

— Indicators of tourism infrastructure development: density of hospitality facilities, i. e. the number of beds at a region’s tourist accommodation establishments per 1 km2.

— Indicators for the presence of objects raising awareness of the country and highlighting its uniqueness in the eyes of international visitors: UNESCO World Heritage sites and contenders located in Estonia<10>, Latvia<11> and Lithuania<12> (2 points awarded for a World Heritage site; 1 for a contender; if there are several such objects, the points are summed).

— It is worth noting that tourism statistics impose a limitation on the choice of the study period and groups of indicators: new methods for statistical data collection and indicator calculation were adopted before the countries acceded to the EU and in their first years as member states. But for the study to be fully comprehensive, some other indicators left out of the list should be explored as well, namely, rail and road density (useful in describing transport infrastructure), the contribution of tourism to the economy of each region and human resources available for the tourism industry. Unfortunately, these indicators have received little research attention due to the failure of some regions to provide the necessary data.

The accuracy of calculations lies at the heart of this study. Particularly, data standardisation was performed to prevent information distortion. The conventional method of the z-transform was employed to reduce the data to a single range of values [33]. Ward’s method was used as well, which allows the identification of a greater number of clusters even when inter-cluster differences are slight. Largely in line with this technique, the Euclidean distance was calculated between the points since larger clusters are composed of micro-clusters having a minimum increase in squared Euclidean distances to the mean values of individual variables [36]. The Kruskal-Wallis test was performed to confirm the method selection and cluster analysis results. The model was chosen based on the lowest sum of asymptotic errors.

The cluster tree, a horizontal dendrogram, makes hierarchical clustering a convenient method to obtain a picture of the possible level of cluster identification. For further cluster analysis, objects are grouped in such a way as to obtain clusters with the most distinct features. In this case, another, iterative, cluster analysis approach is useful, namely, k-means clustering. It is taken to determine the centres of a cluster according to a predetermined number and perform further grouping of objects around the resulting value. The centre of a cluster is the aggregate of average index values of all the objects within it.

This approach is used primarily to identify the features according to which clusters are labelled as the centres, semi-periphery and periphery. The mean values describe the characteristics of a particular cluster. Changes in the mean values of different clusters can point to variations in the weight of certain factors happening over time. The mean index values describe the ‘ideal’ region for the cluster in question, therefore, when these values change, regions can move from one group into another.

Obviously, cluster analysis based on the selected indicators does not provide an exhaustive picture. Adjustments reflecting the specifics of the regions’ development, economic situation and geographical position were made to produce the final version of the classification. The next stage consisted of analysing each cluster in view of the total number of clusters identified and the mean values of applicable indicators. The objective was to determine a cluster’s place within the centre-periphery structure of tourism space, which changes over time. The classification was visualised in cartographic form.

Four clusters were identified in the course of the cluster analysis of the Baltics’ regions. The areas with the highest scores were classified as the core; those with intermediate ones, as semi-periphery; the rest, as periphery. Periphery is divided into two smaller clusters: advanced and deep periphery, the latter associated with the lowest study indicator values.

Results and discussion

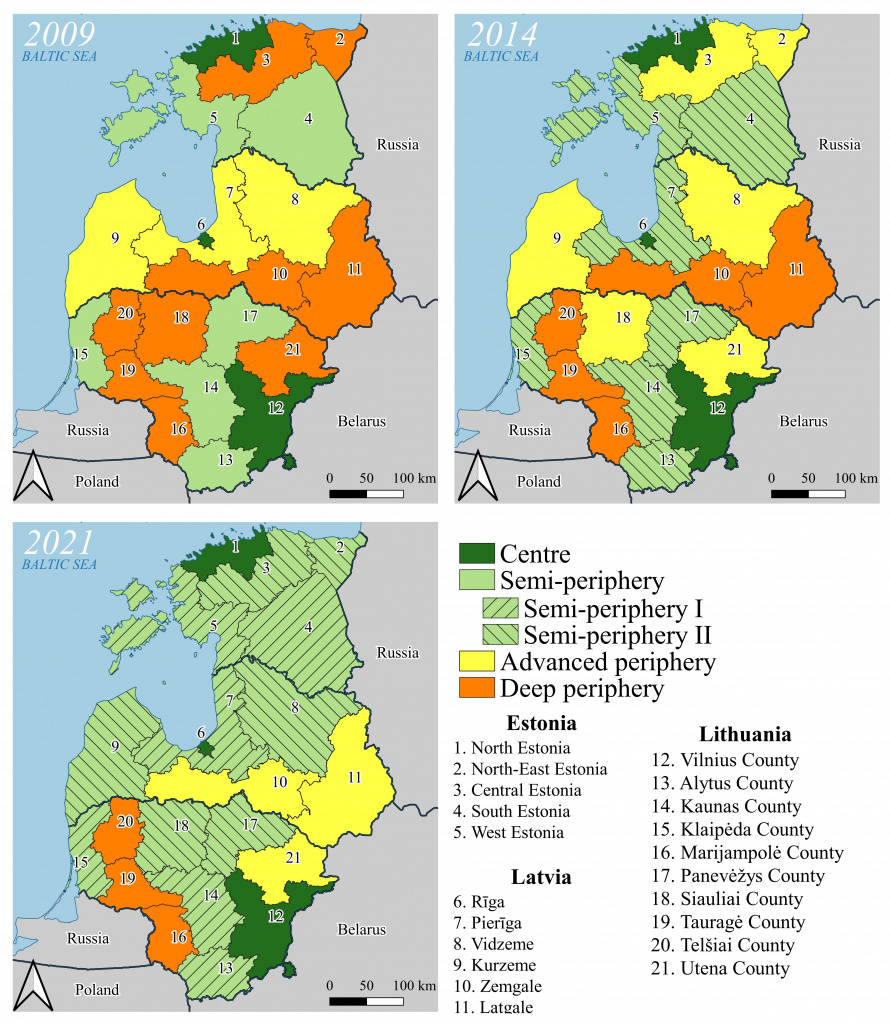

Figure 1 shows the spatial structure of tourism in the Baltics and how it changed between 2009 and 2019.

The core includes a the capital (Riga, Latvia) and capital regions: Vilnius county (Lithuania) and Northern Estonia (Estonia).

The semi-peripheral regions differ in two respects. Some boast historical cities (Tartu in South Estonia) or major seaside and health resort (Druskininkai in Alytus County, Klaipėda in Klaipėda County, Jūrmala and Ķemeri in Pierīga); others have both. West Estonia, for example, is home to the resort town of Pärnu and the Kuressaare Castle on the island of Saaremaa, a UNESCO World Heritage contender. In Kaunas County, there are Kaunas, the former capital of Lithuania, and the health resort Birštonas.

|

| 1 |

| The centre-periphery structure of tourism in the Baltic States, 2009—2019 |

|

|

Peripheral regions do not have a clear specialisation in the tourism market: tending to take advantage of different opportunities to increase their visibility as tourism destinations, they do not have strict preferences.

Table 1 provides some quantitative characteristics of the centre, semi-periphery and periphery of the Baltic States’ tourism space, which differ dramatically in key dimensions. This difference does not disappear over time, testifying to the stability of the core-periphery structure.

|

Indicator |

Centre |

Semi-periphery |

Advanced periphery |

Deep periphery |

||||||||

|

2009 |

2009 |

2014 |

2019 |

2009 |

2014 |

2009 |

2009 |

2014 |

2009 |

2009 |

2014 |

|

|

GDP per capita in current euros |

17.86 |

11.5 |

20.12 |

17.5 |

11.5 |

10.2 |

6.54 |

8.35 |

7.52 |

8.35 |

8.74 |

8.43 |

|

Domestic arrival rate, ‰ |

33.25 |

48.9 |

37.13 |

114 |

48.9 |

92.8 |

22.7 |

15.38 |

20.6 |

15.38 |

57.42 |

50.84 |

|

Regions’ contribution to total domestic arrivals, % |

24.28 |

19.7 |

23.92 |

23.6 |

19.7 |

19.8 |

18.9 |

5.79 |

4.85 |

5.79 |

10.95 |

7.89 |

|

Average length of stay of domestic visitors at local accommodation, nights |

2.21 |

2.57 |

1.98 |

2.05 |

2.57 |

2.48 |

2.06 |

2.07 |

1.91 |

2.07 |

1.76 |

1.75 |

|

Inbound arrival rate, ‰ |

961.1 |

531 |

1762 |

1280 |

531 |

647 |

149 |

111.1 |

54.4 |

111.1 |

218.1 |

142.8 |

|

Regions’ contribution to total inbound tourism, % |

70.08 |

7.74 |

70.37 |

30.8 |

7.74 |

10 |

6.32 |

1.43 |

0.81 |

1.43 |

2.43 |

1.62 |

|

Average length of stay of inbound visitors at local accommodation, nights |

2.09 |

3.52 |

1.84 |

2.36 |

3.52 |

2.64 |

2.39 |

2.13 |

1.9 |

2.13 |

2.44 |

1.76 |

|

Regional accommodation density: beds per 1 km2 |

15.98 |

1.3 |

17.33 |

8.09 |

1.3 |

1.54 |

0.45 |

0.33 |

0.28 |

0.33 |

0.58 |

0.46 |

|

World Heritage sites and contenders |

4 |

2.67 |

4 |

2.78 |

2.67 |

2 |

0 |

0.78 |

1.2 |

0.78 |

0.83 |

2 |

|

International and regional airports |

1.33 |

2.67 |

1.33 |

2.78 |

2.67 |

3 |

4.67 |

0.33 |

0.4 |

0.33 |

1.67 |

0.67 |

From 2009 to 2019, the economy was growing in all the three states. Yet, the progress was uneven across regions. The cores of the tourist space retained their positions: their GDP per capita, albeit having decreased between 2009 and 2019, was approximately twice the national average. The GDP was about the national average in the semi-periphery and below that in the periphery.

Both inbound and domestic tourism have priority in the Baltic States. The main flows of international visitors gravitate towards the cores of tourism space. Depending on the year, North Estonia accounted for 71—74 % of the total inbound tourism in the respective country; Riga, for 77—78 %; Vilnius County, for 58—59 %. Nevertheless, international tourists do not stay long, spending an average of two nights in the capital regions.

The inbound arrival rate in the core regions is generally high, ranging between 96 to 206 ‰ over the study period. The substantial fluctuations may be due to the migration outflow from the Baltic countries, with international tourist flow increasing: during the study period the population of Riga decreased by 7 %, and the number of international tourist arrivals grew 1.5-fold.

Semi-peripheral regions received much fewer international tourists: their contribution varying between 4 % and 16 % of total inbound arrivals. The length of stay of international visitors in such regions slightly exceeded that in the centre regions, varying between 2.5 and 3.5 nights. The inbound tourist arrival rate is stable, in the range of 50—60 ‰. In the semi-periphery of the first order, which became visible by 2019, this proportion is approximately three times that in the semi-periphery of the second order: 90 ‰ and 30 ‰ respectively. Thus, some regions of the semi-periphery were catching up with the core in some respects.

The periphery made a negligible contribution to inbound tourism, of about 2 %. Most of the trips involved about two overnight stays. The average inbound tourism arrival rate for the regions of the advanced periphery did not exceed 22 ‰, whilst for those of the deep periphery it was twice as low (11 ‰).

In contrast to inbound tourism, the role the core has in the domestic tourism market is rather modest, its share not exceeding 30 %. The capital regions, home to most of the Baltics’ population and principal tourist destination, produce most of the domestic tourist traffic without being its principal recipients. Domestic tourism is less intense than inbound travel: the domestic tourist arrival rate is 33—50 ‰. The length of stay by national visitors was approximately two nights.

Domestic tourism is a priority for semi-peripheral regions, which account for almost 20 % of the total numbers. Yet, there is an almost twofold difference between the contribution of the semi-peripheral regions of the first and second order, the average 2019 values being 23 % and 10 % respectively. This becomes especially noticeable when considering the domestic tourist arrival rate. The average value ranged from 50 to 65 ‰ in the semi-periphery and reached almost 90 ‰ in more advanced regions. Although the length of stay of domestic tourists in these regions did not differ from that in the core regions (about two nights), it was shorter than that of international tourists. This may be due to the relatively small size of the countries and, as a consequence, the possibility to make frequent short-term trips.

The peripheral regions are less visible in both inbound and domestic tourism. The advanced periphery accounts for less than 6 % of domestic arrivals, with a domestic arrival rate of 16 ‰; the deep periphery, for 1.5 % (8 ‰).

A distinctive feature of a tourism space core is its developed infrastructure. Accommodation density varies across specific regions, depending on their degree of urbanisation and tourism specialisation. The Riga region, consisting exclusively of the capital city (with 53 beds at tourist accommodation establishments per km2), stands out against the general background. North Estonia, second by a large margin has five beds per 1 km2. Lithuania’s Klaipėda County, where the country’s most popular resorts are located, ranks third. In the semi-peripheral regions of the first order, the accommodation density is only 2 beds per 1 km2; in the second order and periphery, less than 1.

A region’s tourist appeal largely depends on the presence of tourist attractions, particularly World Heritage sites. There is a positive correlation between their number and status, on the one hand, and the volume of tourist flows, on the other. In the Baltics, the number of UNESCO World Heritage sites did not change over the study period. Most of them are located in the core regions. In the semi-periphery and periphery, their number is half that number or absent respectively.

In the Baltics, the capitals are centres of political and administrative life, main transport hubs and principal holiday destinations: they account for over 60 % of international tourist arrivals. The capitals have put the Baltics on the map of tourist destinations; their positive image is contributing to the competitiveness of the three countries as a single macro-region in the global tourism market.

Tallinn, Riga and Vilnius have a wide range of tourism specialisations and are popular amongst domestic and inbound tourists alike. Moreover, they are known as centres of cultural and educational tourism. Historical parts of the cities are UNESCO World Heritage sites. In other words, the core regions and their environs boast sites of world renown, which makes it possible to launch routes within a single tourism product bringing together the core, semi-periphery and periphery. For example, 25 km away from Vilnius, there is a UNESCO site of considerable cultural and historical significance: the archaeological sites of the State Cultural Reserve of Kernavė. The site is part of the Four Capitals of Lithuania route, which runs through Vilnius, Kaunas, Trakai and Kernavė.<13>

The capitals of the Baltics are also visible business tourism centres. This is partially due to the fact that the capital regions take priority in national economic development planning. A comfortable urban environment is being created by building new houses, renovating old ones, opening shopping and leisure spaces, and perking up museums and theatres. The airports of all the three capitals have been reconstructed since 2007. A trend particularly important for a common tourism and recreational space is the new type of business tourism dubbed ‘bleisure’ — business travel combined with recreation. Such programmes make it possible to integrate the capitals’ environs into a single route. The first attempts to organise such tours were made in Latvia by Latvia Tours and Amadeus.<14>.

As emphasised above, the capital regions are leaders in the international inbound tourism market. Various EU instruments and institutions have contributed to their development. Latvia’s Presidency of the EU Council in the first half of 2015 helped to promote the country’s international image and present Riga as a business travel destination. About 200 events were organised during Latvia’s presidency, with 25,000 people staying in Riga for 2—3 days [17].

The Baltic States are active participants in the European Capitals of Culture project supported by the Council of the European Union. Repeated victories in this prominent annual competition have played an important role in raising European tourists’ awareness of the three capitals. This prestigious title was awarded to Vilnius in 2009, Tallinn in 2011 and Riga in 2014.<15> Although most of the initiative’s cultural events were aimed at local audiences and the development of the capitals’ cultural space, economy and infrastructure, their international coverage during the year made a significant long-term contribution to the cities’ international recognition. In a survey of international tourists carried out in Riga in the summer of 2014, 2.9 % of respondents indicated the events held within the European Capital of Culture initiative as the reason for their coming to Riga [37]. The project experience expanded the geography of events and provided an impetus for integrating the cultural and tourist space. Kaunas was selected as one of the European Capitals of Culture for 2022 and Tartu for 2024. The cities are carefully preparing for project implementation.

Major sports events have made a significant contribution to raising awareness of the Baltics as a tourism destination. Twice, in 2006 and 2021, Riga hosted the Ice Hockey World Championships. In 2011, the European Basketball Championship was held in Vilnius, and the European Figure Skating Championship in Tallinn. Some of the sports events engaged sports infrastructure in non-capital regions. For instance, during the 2011 European Basketball Championship, the sports events, visited by 20,000 international tourists, took place in not only Vilnius, but also Alytus, Klaipėda, Šiauliai, Panevėžys and Kaunas [38].

Another important characteristic of a tourism space is connectivity and integrity ensured, amongst other things, by diffusion of innovations within the centre-periphery structure. Innovations in tourism — new types of tourist products, more efficient business models for tourism, better service technologies, and others — spill over from more to less developed areas with holidaymaker and business visitor traffic moving along radial routes from the centre, using developed transport infrastructure around the capital cities. The diffusion of innovations within the tourism industry is also influenced by the movement of capital and workforce.

Integration into the pan-European space plays a special role in spreading innovation in the Baltic States. Innovations enter the capital regions from abroad through horizontal links. Then, they spread vertically within the country, from more to less developed areas. For example, the opening of Radisson hotels in Vilnius and, later, Kaunas<16> improved the quality of tourist services and stimulated the introduction of international hospitality standards.

A principal form of cross-border cooperation in Europe is Euroregions. Groups of regions of EU member states conclude agreements with states bordering the Union sign and run joint projects, including tourism initiatives [12]. The Baltics participate in 12 projects at different levels, some of them involving Baltic Sea countries.<17> Such partnerships give participants in the tourism market ample opportunities to embrace best practices in due time.

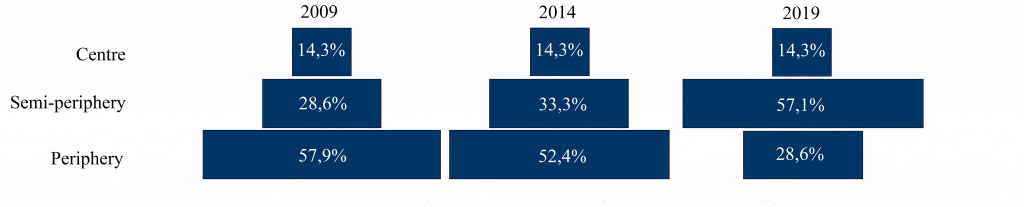

Despite being persistently reproduced, the centre-periphery structure of the Baltics’ tourism space changes over time. In the course of evolution, the traditional pyramid-like structure is becoming increasingly barrel-shaped. Between 2009 and 2019, the semi-periphery group grew. Gravitating towards the cores, it ensures innovation spillover from the capitals to the periphery (Fig. 2). An expanding network of tourist routes and the growing geography of tourist traffic in the semi-periphery facilitates the development of the tourist space of Estonia, Latvia and Lithuania. This change involved new territories into innovation exchange and spurs business activity in their tourism market, reducing spatial polarisation and risks of system ruptures.

|

| 2 |

| Change in the centre-periphery structure of inbound and domestic tourism in the Baltics, 2009—2019 |

|

|

Conclusions

Cluster analysis has proved useful in studying the territorial structure of tourism. It shows that the factors, conditions and results of tourism activities exhibit spatial differentiation and the tourism space of the Baltics has a pronounced, highly polarised centre-periphery structure. This hierarchical organisation is being transformed as the countries adapt to new conditions relating to their accession to the EU. Other major influences include the states’ transit position, persisting historical ties with different groups of countries and a historical footing for current tourism development.

In the territorial structure of the Baltics’ tourism, the capital regions act as ‘growth areas’ that are competitive in the international, primarily European, travel market and capable of attracting international tourists. The other regions receive tourists from the cores, specialising chiefly in domestic tourism. Local centres in the semi-peripheral regions are rapidly developing, attracting inbound traffic and catching up with the cores.

The changes that occurred in the Baltic States between 2009 (and especially 2014) and 2019 point to some continuous trends in domestic and inbound tourism. The territorial structure is becoming more complex: despite the persistence of polarisation and the presence of absolute leaders (the capital regions), the semi-peripheral territories split into two groups. The semi-periphery of the first and second order became visible by 2019. The peripheral regions, located at a distance from the Baltic Sea and traditional tourism centres, are becoming progressively involved in tourism. They must be integrated into tourist routes to become a constituent part of the tourism space.

Despite some improvements in the situation of the peripheral regions and the evolution of the centre-periphery structure of the Baltics’ tourism space, the gap between the core and the less developed regions remained substantial in 2019. Narrowing this gap is the key to further progress and the formation of stable and balanced tourism structures in the Baltics. Tourist periphery requires effective promotion in domestic and international travel markets, with the former having priority. The international campaign may focus on not only territories traditionally producing tourist traffic to the Baltics but also new Asian countries of origin. By continuing to create innovative products and solutions, the core will expand the geography of tourist trips and redistribute existing tourist flows in favour of less developed areas. This can be implemented through special marketing efforts, original niche tourism products, participation in the EU interregional cooperation programmes, taking advantage of state support tools that proved effective during the pandemic, etc.

The COVID-19 pandemic and subsequent geopolitical changes have had a negative impact on the Baltics’ tourism market. As ‘driving forces’, the core regions were forced to respond to new economic challenges by offering new solutions. With visa formalities tightened on the part of the Baltic States and Baltic transit to the Schengen area denied to Russian citizens, the semi-periphery and periphery sharing a border with Russia and Belarus no longer serve a prominent role as transit territories. If these restrictions persist, structural changes in the travel geography of the Baltic States will take place, with the countries becoming even more closely integrated into the Western European travel market; existing tourism products will be adjusted to meet the needs of EU consumers; the positive changes in the periphery and semi-peripheral will slow down.

Further research should be undertaken to explore the spatial structure of the Baltics’ tourism market. The evolution of a complex phenomenon such as tourism, especially amid a deteriorating macro-situation and growing uncertainty, is in need of scientific support and even foresight. The required geographical analysis looks promising in the virtual absence of up-to-date, complete and reliable tourism statistics. It may help make decisions regarding the spatial organisation of tourism and bring them in line with the tourist ‘experience of the territory’ (by analogy with the ‘economic and geographical experience of the territory’ proposed by Leonid Iofa). This will increase the competitiveness of the Baltic States in the tourism market and turn tourism into an even more efficient a tool for comprehensive and sustainable development of territories.